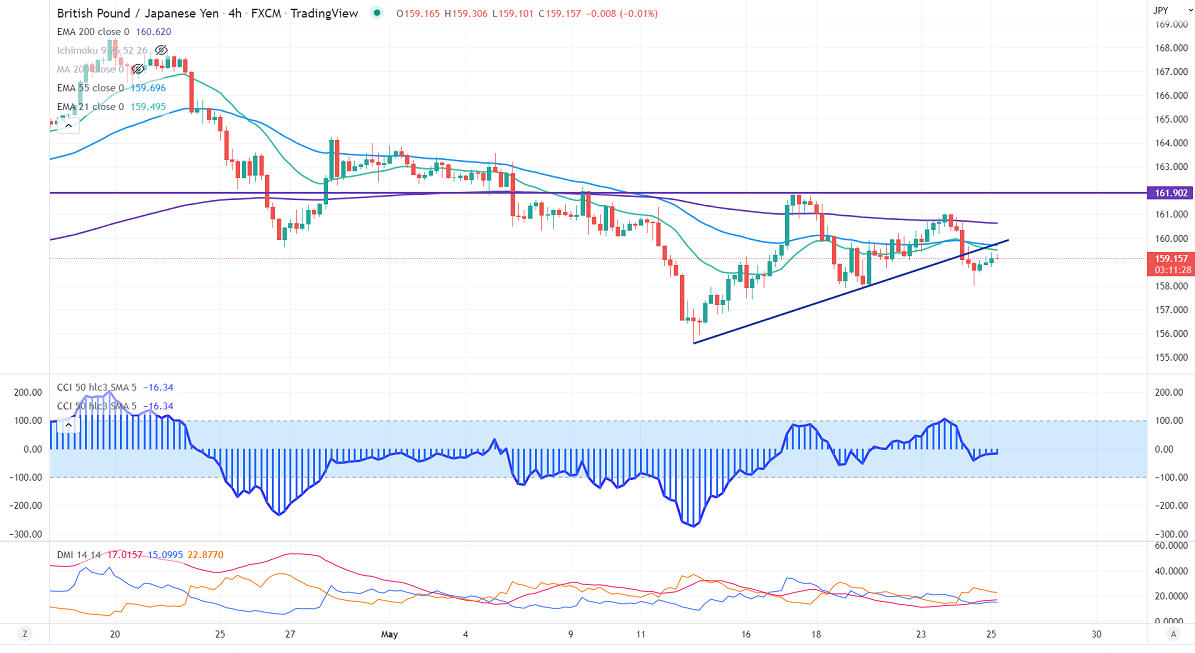

GBPJPY formed a double bottom around 157.90 and showed a minor pullback. The pound sterling regained above 1.2500 after hitting a low of 1.24755 on upbeat market sentiment. Markets eye US Fed meeting minutes for further direction. UK flash manufacturing PMI came at 54.6 in May vs estimate of 54.90. Any breach above 1.2620 (200-4H EMA) confirms further bearishness. GBPJPY hits an intraday low of 159.38 and is currently trading around 159.17.

USDJPY

USDJPY holds below 127 on weak economic data weighing on the growth outlook. A dip to 125 is possible.

Technicals:

On the lower side, immediate support is around 159, breach below will drag the pair to the next level to 158/157/155. The minor resistance to be watched is around 160.50, a break above that level confirms intraday bullishness, and a jump to 161/162/164.25/165 is possible.

It is good to sell on rallies around 159.85-90 with SL around 161.20 for the TP of 155.