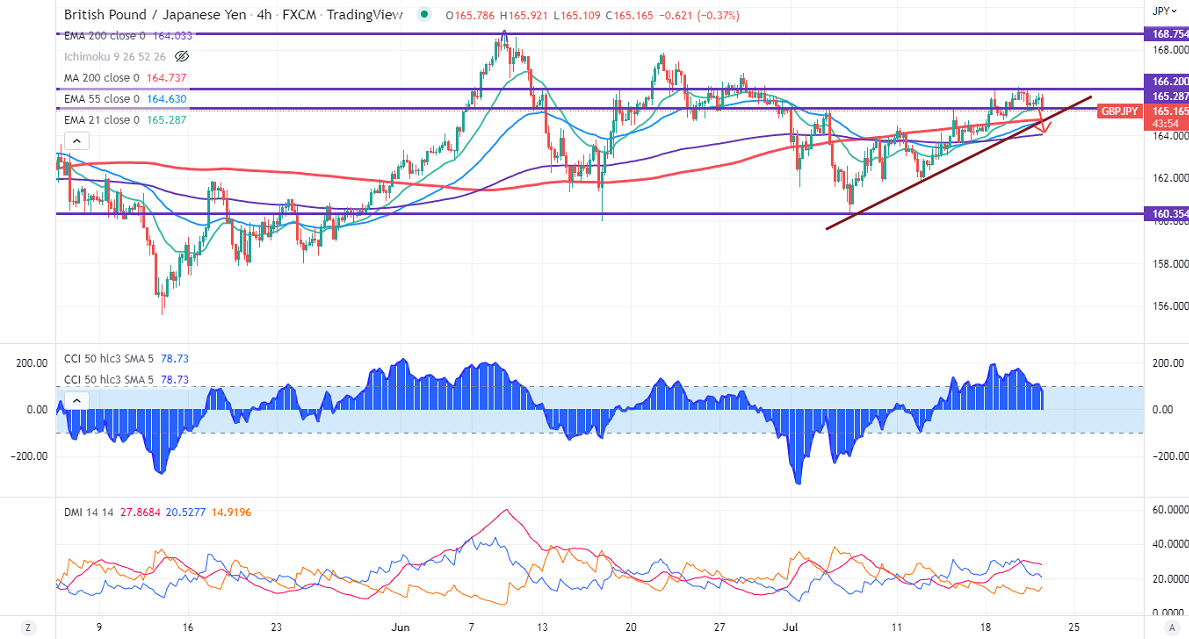

GBPJPY trades in a narrow range between 166.18 and 165.13 for the past three days. The pound sterling lost its shine as a drop in core CPI may reduce the chance of a higher rate hike. Any break below 1.19150 confirms further bearishness. Technically in the 4-hour chart, the pair is holding above short-term 21-EMA, 55 EMA, and long-term 200 EMA (164.02). Any breach below 165 will drag the pair down to take it to the next level to 164.70/163.97. GBPJPY hits an intraday low of 165.10 and is currently trading around 165.16.

The near-term resistance is around 166, any breach above targets 167/169.

Indicators (4-hour chart)

CCI (50) - Bullish

ADX- Neutral

It is good to sell on rallies around 165.50-55 with SL around 166.25 for TP of 163.