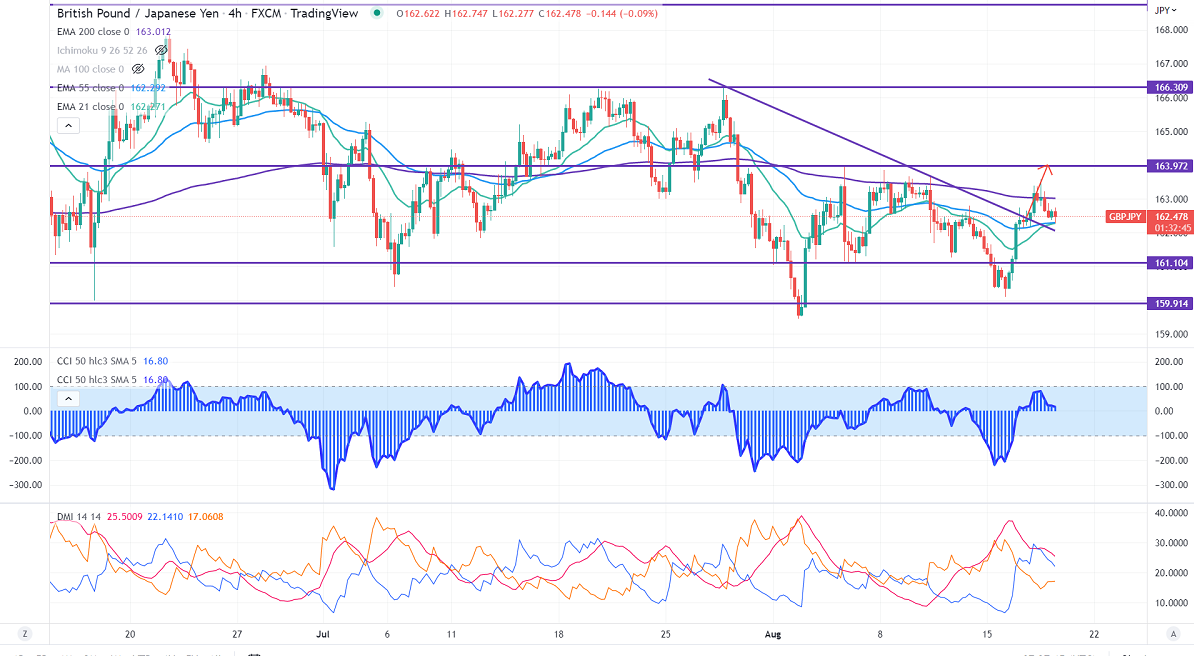

GBPJPY pared some of its gains on the weak pound sterling. It lost nearly 150 pips against the US dollar after the Fed meeting minutes. The chance of an aggressive rate hike by BOE increased after upbeat UK inflation data. Any close below 1.2000 confirms further bearishness. Technically in the 4-hour chart, the pair is holding above short-term 21-EMA, 55 EMA, and below long-term 200 EMA (163.01). Any violation past 162.75 takes to the next level 163.60/164. Any breach above 164 confirms a minor bullish trend. A jump to 165/166.30 is possible.GBPJPY hits an intraday high of 162.79 and is currently trading around 162.68.

The near-term support is around 162, a breach below targets 161.50/160.

Indicators (1-hour chart)

CCI (50) – Bullish

ADX- Neutral

It is good to buy on dips around 162.35-40 with SL around 161.50 for TP of 164/165.