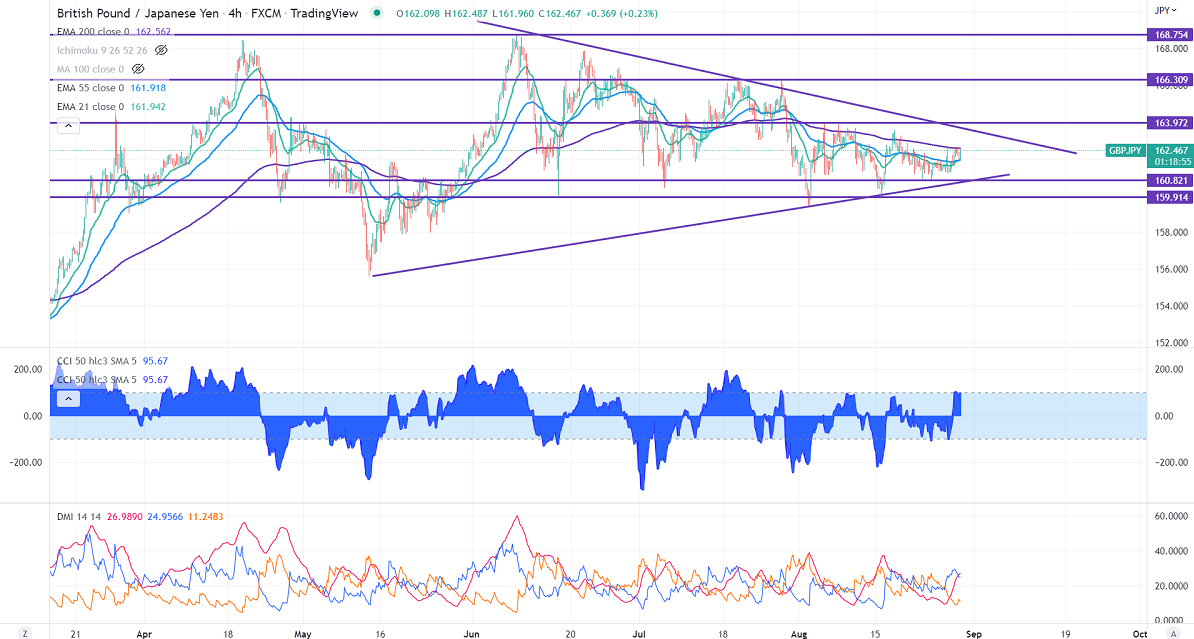

GBPJPY showed a minor jump above 162 levels on short covering in pound sterling. It was one of the worst performers against the US dollar as surging energy costs will hurt the UK economy. The yen performed well after upbeat Japanese employment data. Technically in the 4-hour chart, the pair is holding above short-term 21-EMA, 55 EMA, and below long-term 200 EMA (162.58). Any violation below 161.80 takes to the next level 160.80/159/158. GBPJPY hits an intraday high of 162.55 and is currently trading around 162.30.

The near-term resistance is around 162.60, a breach above targets 163/164.

Indicators (4-hour chart)

CCI (50) – Bearish

ADX- Bearish

It is good to buy on dips around 162.15-20 with SL around 161.20 for TP of 164.