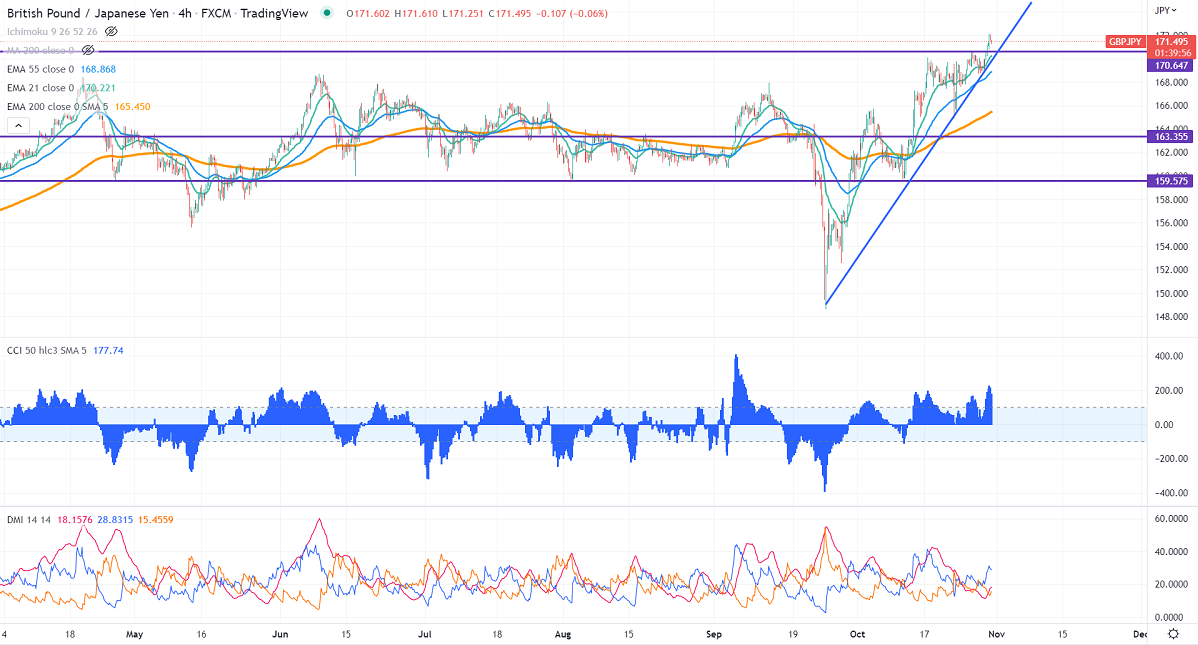

GBPJPY dropped slightly after a massive jump the previous week. The jump in pound sterling due to UK political stability and hawkish BOE. The yen lost more than 300 pips against the USD on policy divergence between US Fed and BOJ. Any surge above 1.6600 will take GBPUSD to next level 1.17250. Technically in the 4-hour chart, GBPJPY holds above short-term 21-EMA, 55- EMA, and long-term 200 EMA (165.38). Any convincing close above 172 will take the pair to the next level 173.15/175. GBPJPY hits an intraday low of 171.25 and is currently trading around 171.45.

The near-term support is around 170, a breach below targets 168.75/167.84/167.40.

Indicators (4-hour chart)

CCI (50) – Bullish

ADX- Bullish

It is good to buy on dips around 170 with SL around 168.75 for a TP of 174.80.