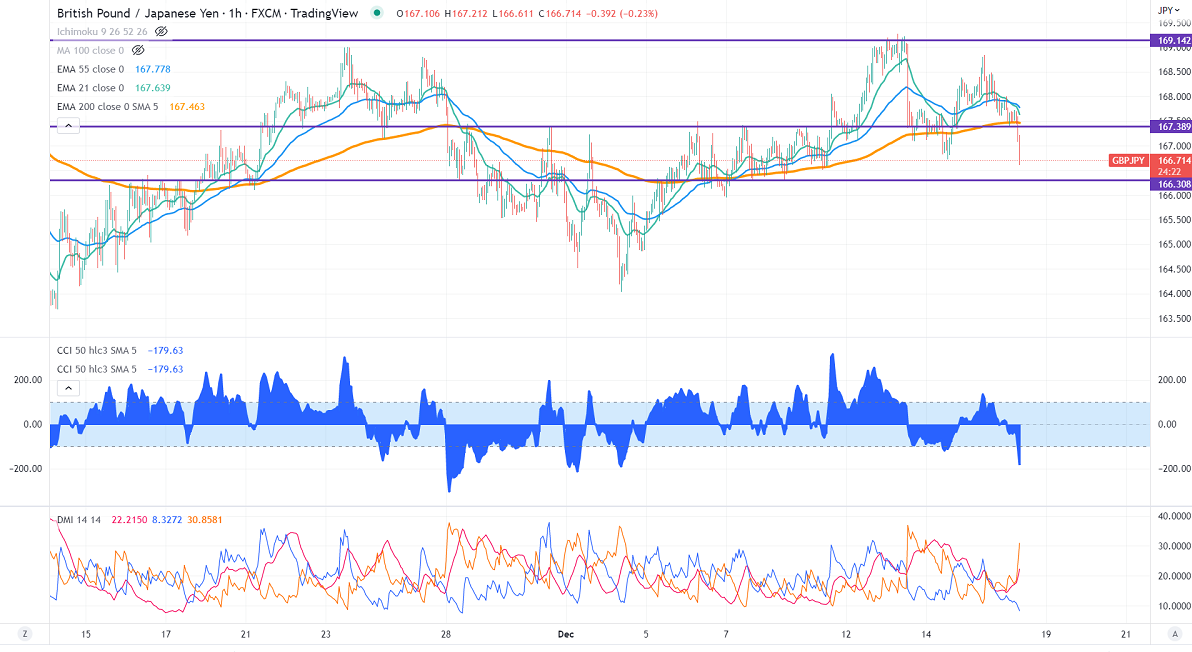

GBPJPY pared some of its gains after BOE monetary policy. It hits an intraday low of 167.37 and is currently trading around 167.58.

GBPUSD- Trend- Bearish

The cable pared some gains after BOE's dovish rate hike. The central bank increased the rate by 50 bpbs to 3.5% on Thursday. The nine-member committee splits in three ways. Six members voted for a half-point rise. Catherine Mann preferred a 0.25% hike. The other two want rates to be unchanged.ng lower. Any break below 1.2150 confirms further bearishness. UK retail sales dropped unexpectedly by 0.40%, compared to a forecast of 0.30%.

USDJPY- Bearish

The pair halted its massive pullback and showed a minor profit booking. The policy divergence between US Fed and BOJ puts pressure on the yen. Any close above 138.15 confirms a bullish continuation. Minor support is 136.75/135.80.

GBPJPY analysis-

The near-term support is around 166.70, a breach below targets 165.95/165. The immediate resistance is at 168.60, a jump above will take the pair to 169.30/170/172.

Indicators (4-hour chart)

CCI (50) – Bearish

ADX- Bearish

It is good to sell on rallies around 167-167.10 with SL around 168 for a TP of 165.