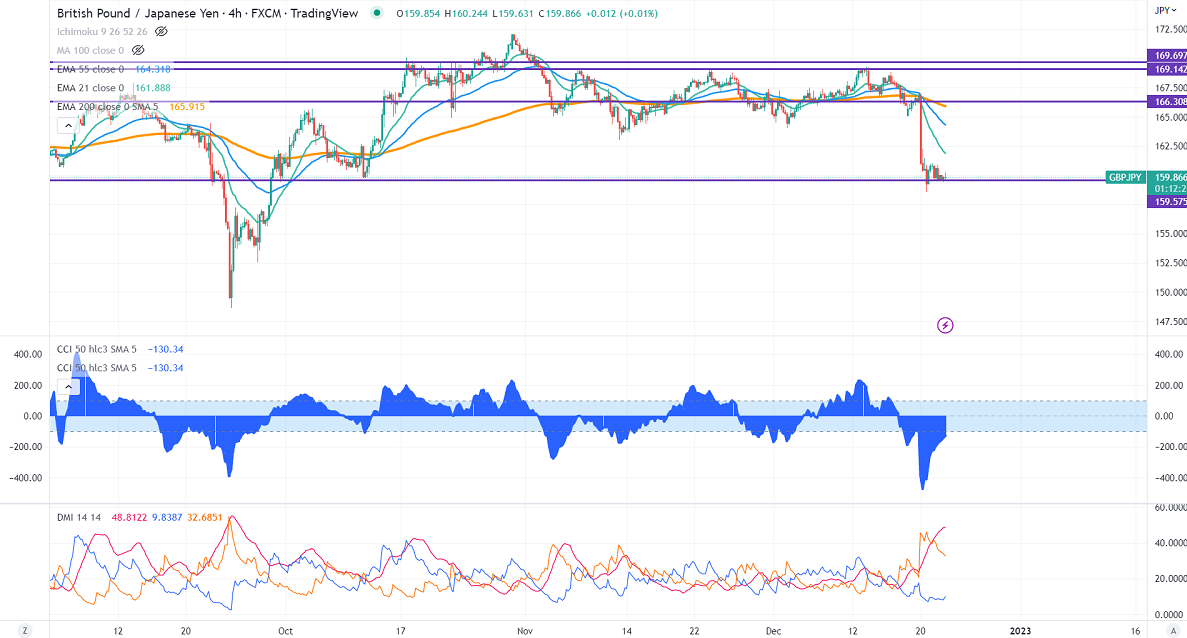

GBPJPY trading in a narrow range between 158.57 and 161.03 after a major sell-off. It hits a low of 159.63 and is currently trading around 159.79.

GBPUSD- Trend- Bearish

The cable showed a minor pullback despite weak UK GDP data. UK economy contracted by 0.30% in the third quarter, below the estimate of -0.20%. Markets eye US final GDP and initial jobless claims for further direction. Any break below 1.2050 confirms further bearishness.

USDJPY- Bearish

The pair consolidates after 600 pips decline, the biggest single-day slump in 24 years. Any close above 133 confirms a bullish continuation. Minor support is 131.50/130.

GBPJPY analysis-

The near-term support is around 158.50, a breach below targets 156/155. The immediate resistance is at 160.25, a jump above will take the pair to 161.10/161.85/163.

Indicators (4-hour chart)

CCI (50) – Bearish

ADX- Bearish

It is good to sell on rallies around 162 with SL 163 for a TP of 158.