GBPJPY recovered above 160 on the strong pound sterling. It hits an intraday high of 160.13 and is currently trading around 160.10.

GBPUSD- Trend- Bullish

The cable jumped more than 300 pips after mixed US jobs data. The US economy added 223000 jobs in Dec, lower than 256K (revised data for Dec). Unemployment declined to 3.5%, a per-pandemic low. Average hourly earnings m/m came at 0.30%, below the estimate of 0.40%. Any close above 1.2200 will take the pair to 1.2250/1.2270.

USDJPY- Bearish

The pair pared most of its gains after a minor pullback to 134.77. Major resistance is 132.70/134/134.80.

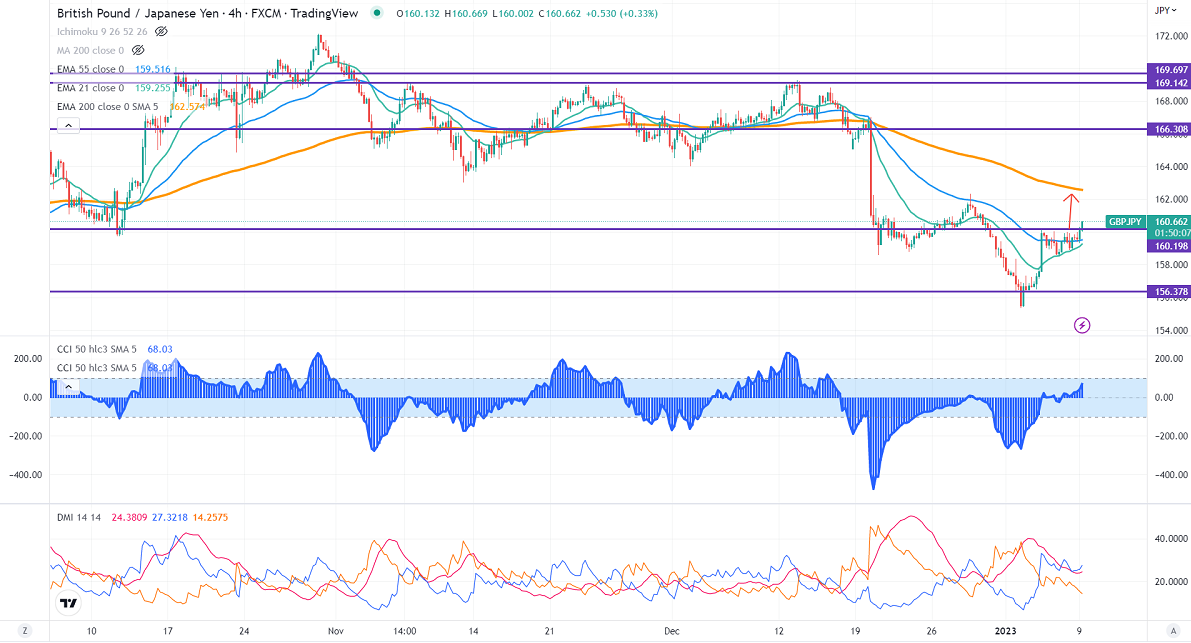

GBPJPY analysis-

The near-term support is around 159.80, a breach below targets of 159/158.50/157.70. The immediate resistance is around 160.60, a jump above will take the pair to 161.50/163.

Indicators (4-hour chart)

CCI (50) –Bullish

ADX- Bullish

It is good to buy on dips around 160.38-40 with SL around 159.80 for a TP of 163.