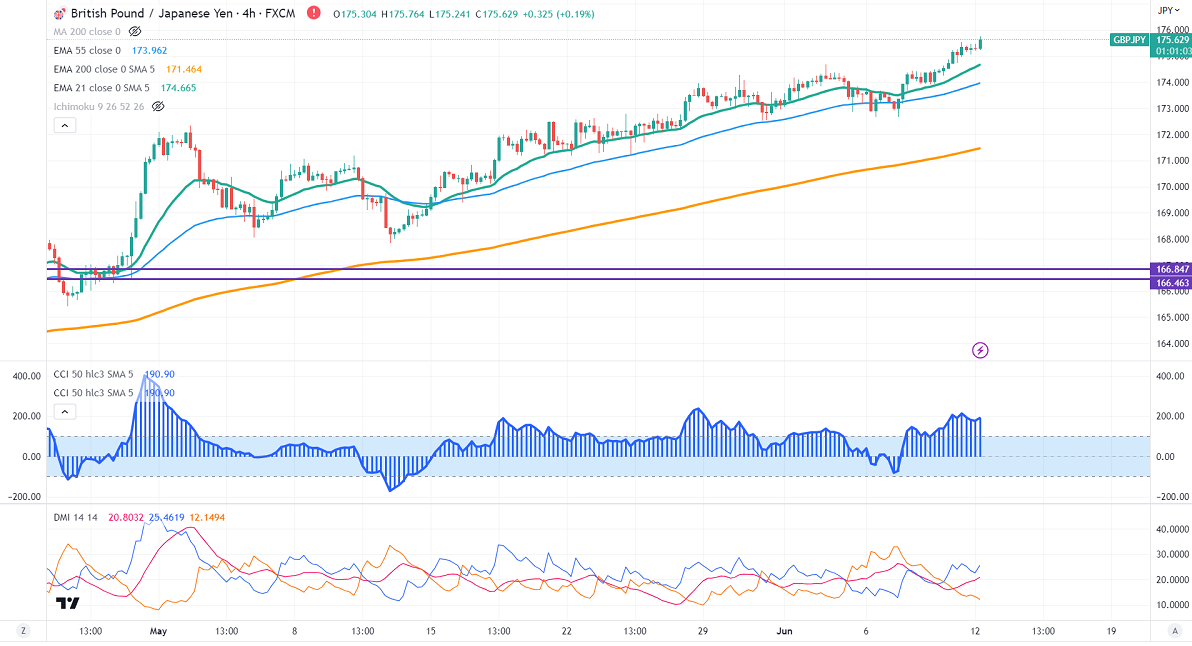

GBPJPY traded higher for the third consecutive week on the strong pound sterling. It hits an intraday high of 175.59 and is currently trading around 175.525.

GBPUSD- Trend- Bearish

The pound sterling climbed higher against USD and hits its highest level since May 10th, 2023. the US dollar came under pressure after weak US jobless claims data. Markets eye US Fed funds rate on Wednesday for further direction. Any break above 1.2600 confirms further bullishness.

USDJPY- Bullish

The pair is trading in a narrow range between 140.24 and 138.75 for the past five days. Significant Support is 138.75/138.

GBPJPY analysis-

The near-term support is around 175, a breach below targets 174.70/174. The immediate resistance is at 176, any violation above will take the pair to 177/178.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to buy on dips around 175 with SL around 174 for a TP of 177/178.