GBPJPY trading in a narrow range between 175.76 and 174.34 for the past three days. It hits an intraday high of 175.31 and is currently trading around 175.525.

GBPUSD- Trend- Bearish

The pound sterling climbed sharply after upbeat UK employment data. The number of people who have filed for unemployment benefits dropped to 13600 compared to a forecast of 214000. The unemployment rate dropped to 3.80% in May from 4%. Markets eye US CPI data today for further direction. Any break above 1.2600 confirms further bullishness.

USDJPY- Bullish

The pair is trading in a narrow range between 140.24 and 138.75 ahead of the US CPI. Significant Support is 138.75/138.

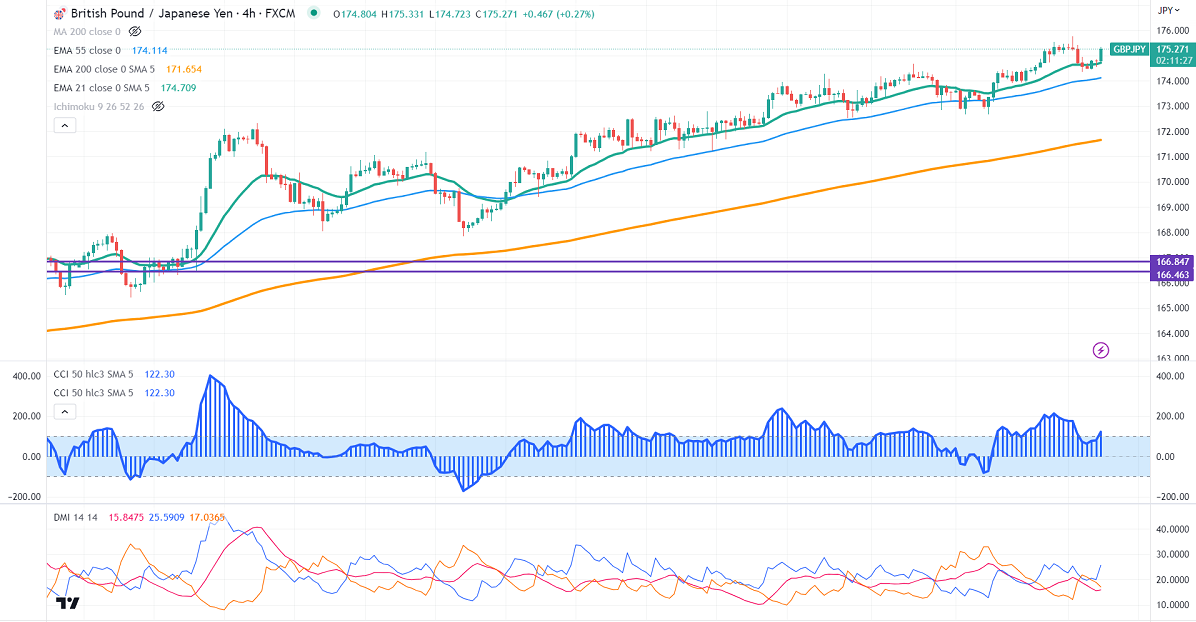

GBPJPY analysis-

The near-term support is around 175, a breach below targets 174.70/174. The immediate resistance is at 176, any violation above will take the pair to 177/178.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to buy on dips around 175 with SL around 174 for a TP of 177/178.