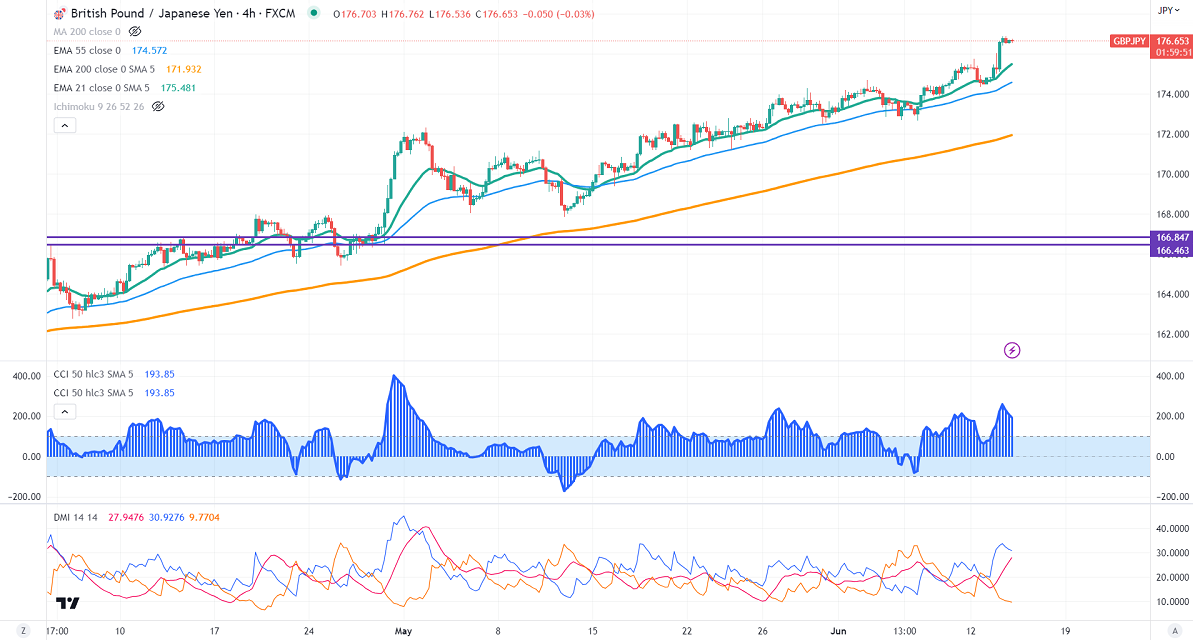

FxWirePro- GBPJPY Daily Outlook

GBPJPY hits a fresh seven-year high on strong Pound sterling. It hits an intraday high of 176.88 and is currently trading around 176.754

GBPUSD- Trend- Bearish

The pound sterling climbed sharply after weak US inflation data.US core CPI rose 4% in May from 4.9% in Apr, the lowest level since Mar 2021 in Apr. US May inflation rate at 0.10% (MoM) Vs Est 0.30%. This has increased the chance of a rate pause by the Fed in the coming months. The policy divergence between US Fed and BOE pushed the GBP prices higher. Any break above 1.2630 confirms further bullishness.

USDJPY- Bullish

The pair trades above the 140 level despite weak US CPI. Significant Resistance is 141/143.

GBPJPY analysis-

The near-term support is around 176.50, a breach below targets 175.80/175/174.70. The immediate resistance is at 177, any violation above will take the pair to 178/180.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to buy on dips around 176 with SL around 174.70 for a TP of 180.