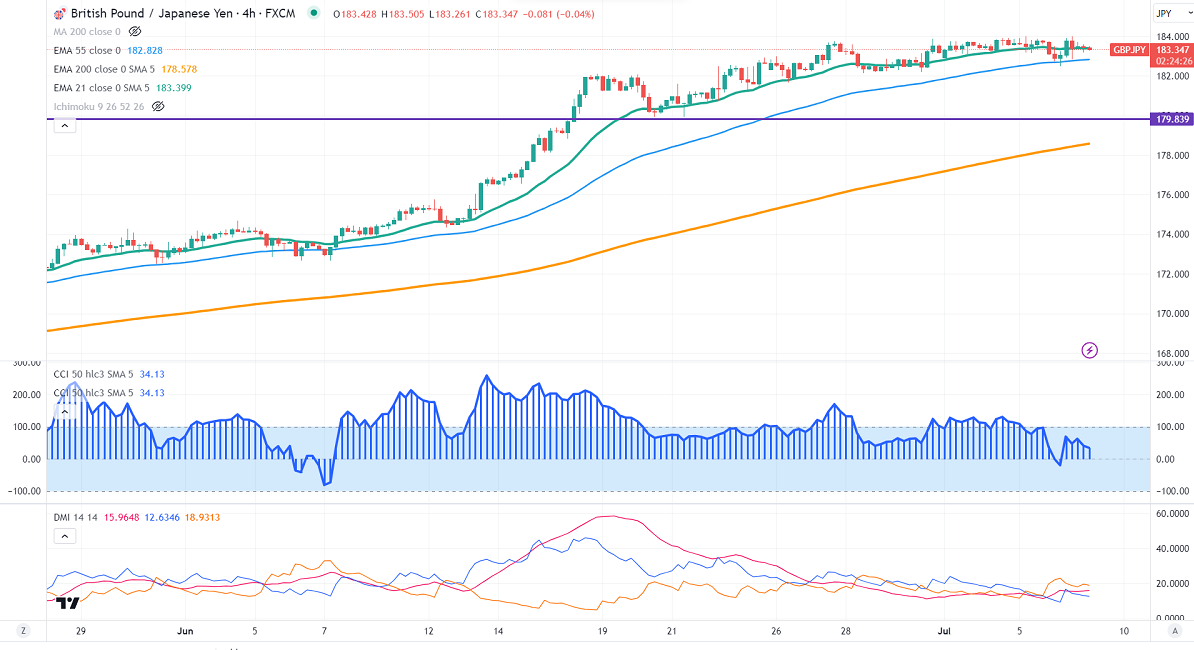

GBPJPY showed a minor pullback on the strong Pound sterling. It hits a high of 184 and is currently trading around 183.23.

GBPUSD- Trend- Bullish

The pound sterling pared some of its gains after upbeat US ADP employment. US private sector payrolls have added 497000 jobs in June, well above expectations of 226000. US services PMI picked up faster in June to 53.9 Vs forecast of 51.30. Any break above 1.2800 confirms further bullishness.

USDJPY- Bullish

The pair is trading flat ahead of US NFP data. Any upbeat jobs data will push the pair further higher. Significant Resistance is 143.70/143.35.

GBPJPY analysis-

The near-term support is around 182.50, a breach below the targets 182/181.20/180. The immediate resistance is at 184, any violation above will take the pair to 185/186.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Neutral

It is good to sell on rallies around 184 with SL around 185 for a TP of 180.