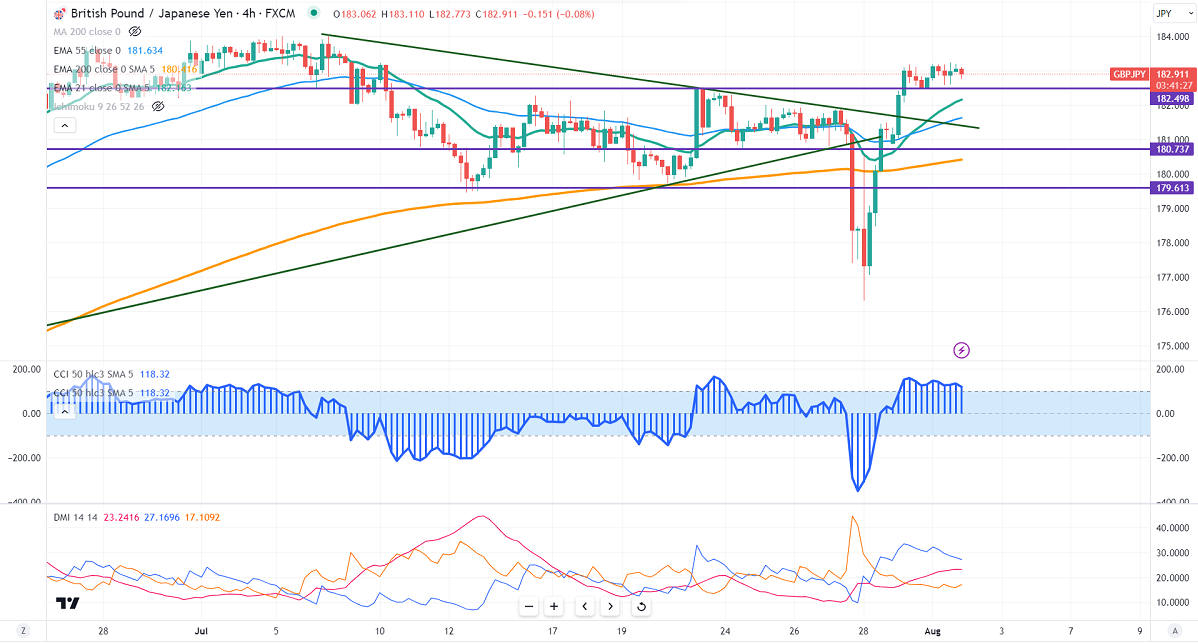

GBPJPY consolidating between 183.19 and 182.50 for the past two days. It hit a low of 182.58 yesterday and is currently trading around 182.97.

GBPUSD- Trend- Bullish

The pound sterling hits three weeks low on board-based US dollar buying. The S&P Global/CIPS UK manufacturing PMI dropped to seven month low at 45.3 in July, slightly above the estimate of 45. Markets eye US ADP employment data for further direction. Any break below 1.2720 confirms further bearishness.

USDJPY- Bullish

The pair surged 500 pips from a temporary bottom of 138.05 on dovish BOJ. The significant resistance is 143.60/145.

GBPJPY analysis-

The near-term support is around 182.50, a breach below the target of 182/181.50/180.80/180. The immediate resistance is at 183.25, any violation above will take the pair to 184/185.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to buy on dips around 182.55 with SL around 181.55 for a TP of 185.