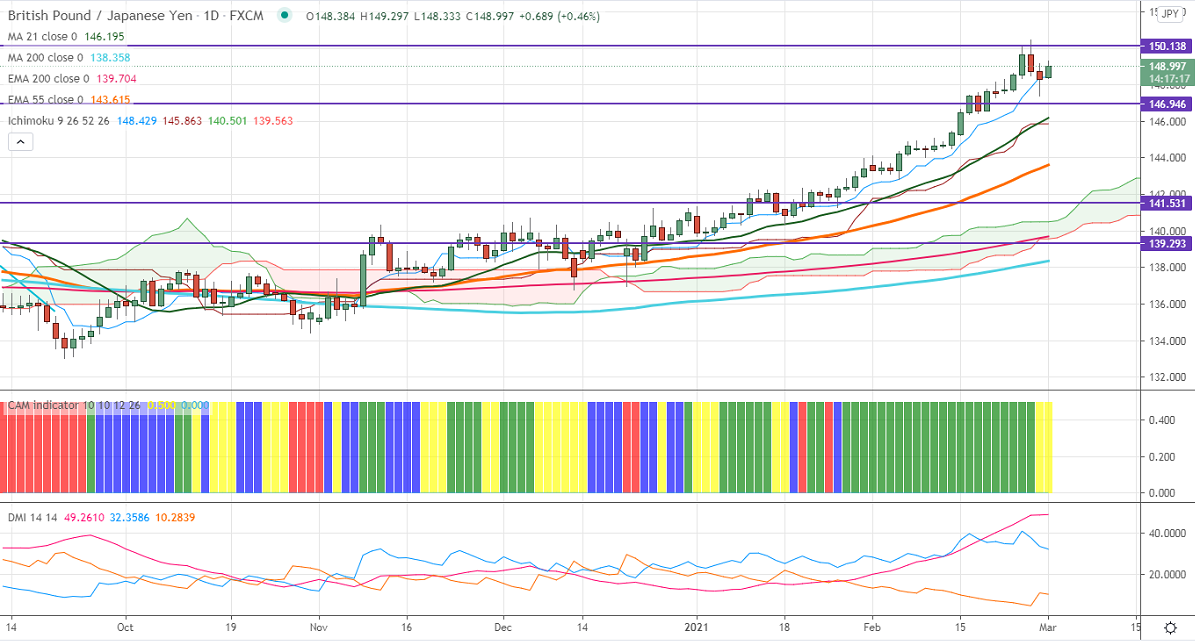

Ichimoku Analysis (Hourly Chart)

Tenken-Sen- 148.402

Kijun-Sen- 145.86

GBPJPY lost more than 150 pips from minor top 150.44 on broad-based Pound sterling weakness. GBPUSD is trading below 1.4000 on broad-based US dollar selling. UK's finance minister Rishi Sunak to provide 5 billion sterling to coronavirus affected business. USDJPY continues to trade higher and holding above 106 as the yen is inversely related to the bond yield. The intraday trend of GBPJPY is bearish as long as resistance 147.20 holds.

Technical:

The pair is facing significant resistance at 150.50, a jump to 151.50/153. On the lower side, near-term support is around 148. An indicative break below will drag the pair down to 147.20/146.40/145.85. Significant trend reversal only below 144. A violation below will drag the pair to 142.80.

Indicator (Daily chart)

CAM indicator –Neutral

Directional movement index – Neutral

It is good to buy on dips around 149 with SL around 148 for the TP of 151.50.