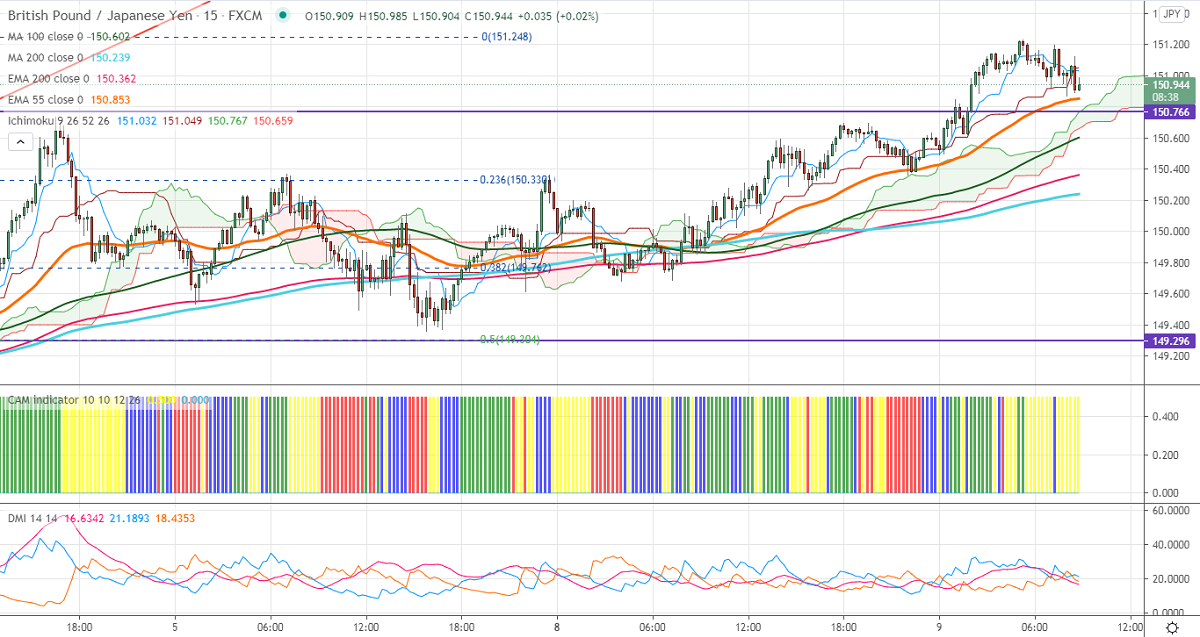

Ichimoku Analysis (Daily Chart)

Tenken-Sen- 151.01

Kijun-Sen- 151.03

GBPJPY has broken significant resistance 150.70 after a long consolidation. The jump was mainly to surge in pound sterling on minor weakness in US dollar. GBPUSD jumped more than 80 pips on a slight decline in US bond yield. USDJPY is facing strong resistance at 109.05; any jump above confirms trend continuation. The short-term trend of GBPJPY is bullish as long as support 149.40 holds.

Technical:

The pair is trading well above 150 levels, any close above 151.20 confirms further bullishness. A jump to 152.70/154 is possible. On the lower side, near-term support is around 150.30. An indicative break below will drag the pair down to 150/149.76/149.40. Significant trend reversal only below 147.40.

Indicator (15 min chart)

CAM indicator –Neutral

Directional movement index –Neutral

It is good to buy on dips around 150.50 with SL around 149.40 for the TP of 153.