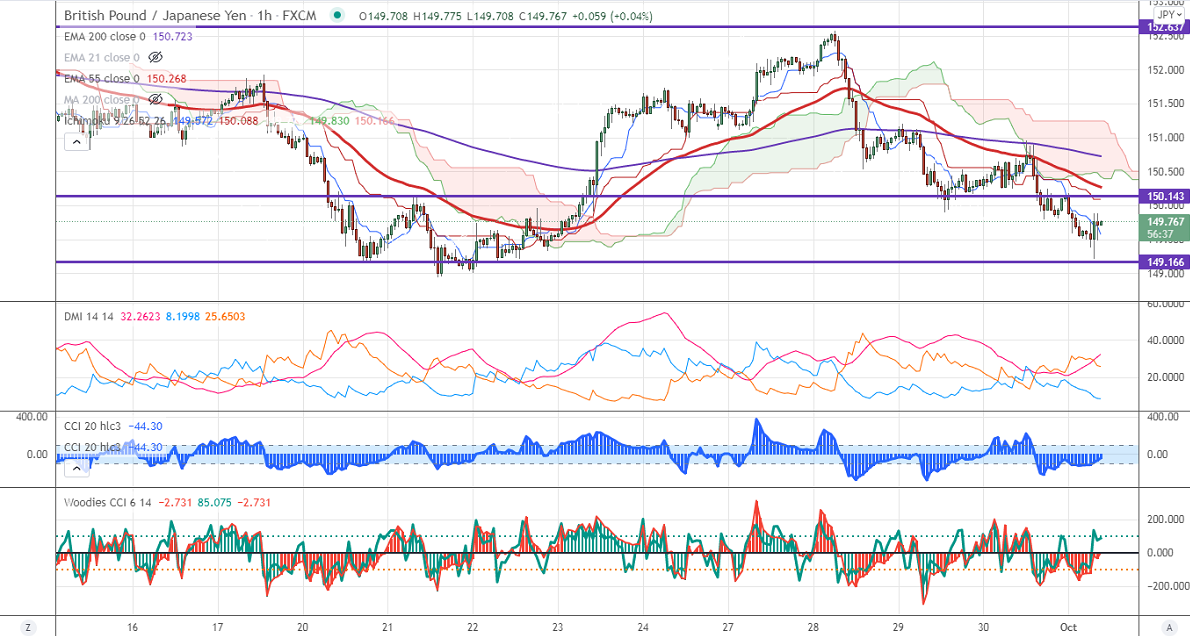

Major Intraday resistance -150.35

Intraday support- 149

GBPJPY is trading weak for the fourth consecutive day and lost more than 200 Pips on board-based Pound sterling selling. The pound sterling was one of the worst performers this week against the US dollar on the petrol crisis in the UK. GBPUSD hits a multi-month low of 1.3415 despite better than expected UK GPD data. It came at 5.5% for the second quarter against the forecast of 4.8%.GPJPY hits an intraday low of 149.22 and is currently trading around 1. The intraday trend of GBPJPY is bearish as long as resistance 151 holds.

USDJPY- Analysis

The pair declined after hitting a multi-year high at 112.06. It should close above 112.25 for major bullishness.

CCI Analysis-

The CCI (50) and Woodies CCI are trading below zero lines in 60 min chart. So the trend for the intraday is bearish.

Technical:

The pair's immediate resistance is around 150.35, any surge above targets 150.75/ 151.30/151.80/152/152.60. Significant bullish continuation if it breaks 153.50. On the lower side, near-term support is around 149. Any indicative violation below targets 148.40/147.

Indicator (Hourly chart)

Directional movement index –bearish

It is good to sell on rallies around 149.75-80 SL around 150.45 for a TP of 148.