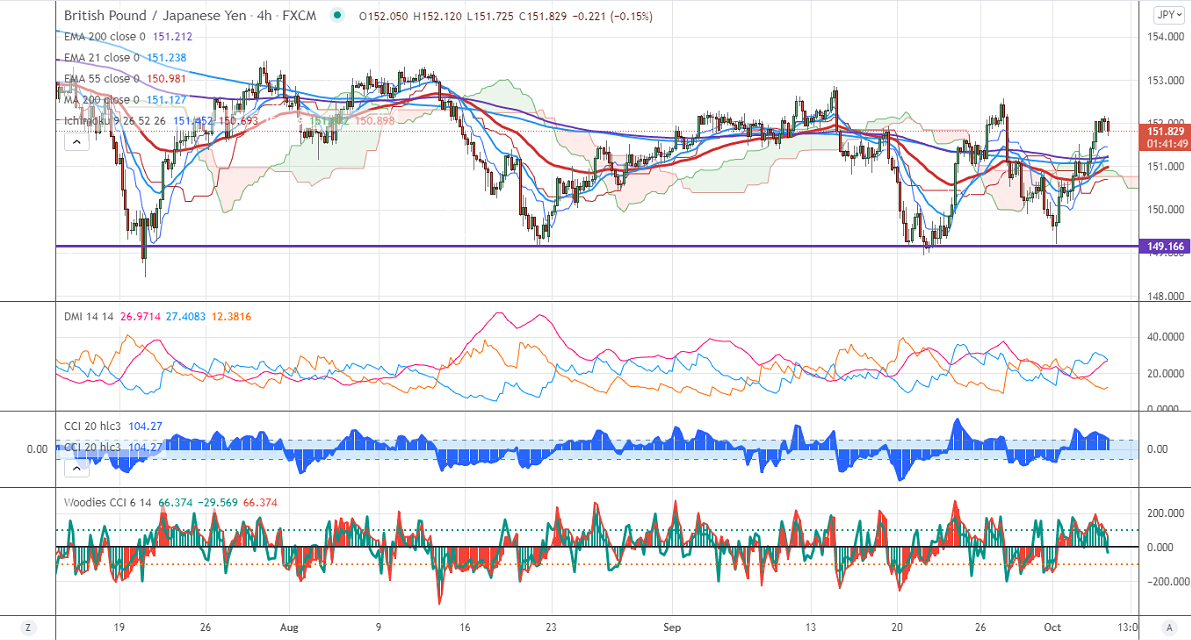

Major Intraday resistance -152.60

Intraday support- 151.30

GBPJPY continues to trade higher for the past four trading days and jumped nearly 300 pips on Japanese yen weakness. The pound sterling has halted its four-day winning streak against the US dollar in a risk-off mood. The surge in energy costs and the US debt ceiling is dampening market sentiment. GBPJPY hits an intraday high of 152.15 and is currently trading around 151.76.

USDJPY- Analysis

The pair has recovered sharply after hitting a six-day low at 110.81 on surging US Treasury yields. Any breach above 112.25 confirms bullish continuation.

CCI Analysis-

The CCI (50) and Woodies CCI are trading above zero lines in 60 min chart. In Woodies CCI six consecutive bars above zero confirm the uptrend.

Technical:

The pair's immediate resistance is around 152.60, any surge above targets 153/153.50. Significant bullish continuation if it breaks 153.50. On the lower side, near-term support is around 151.40. Any indicative violation below targets 150.96/150.60/150/149.20.

Indicator (Hourly chart)

Directional movement index –Bullish

It is good to buy on dips around 151.30-35 SL around 150.60 for a TP of 152.58.