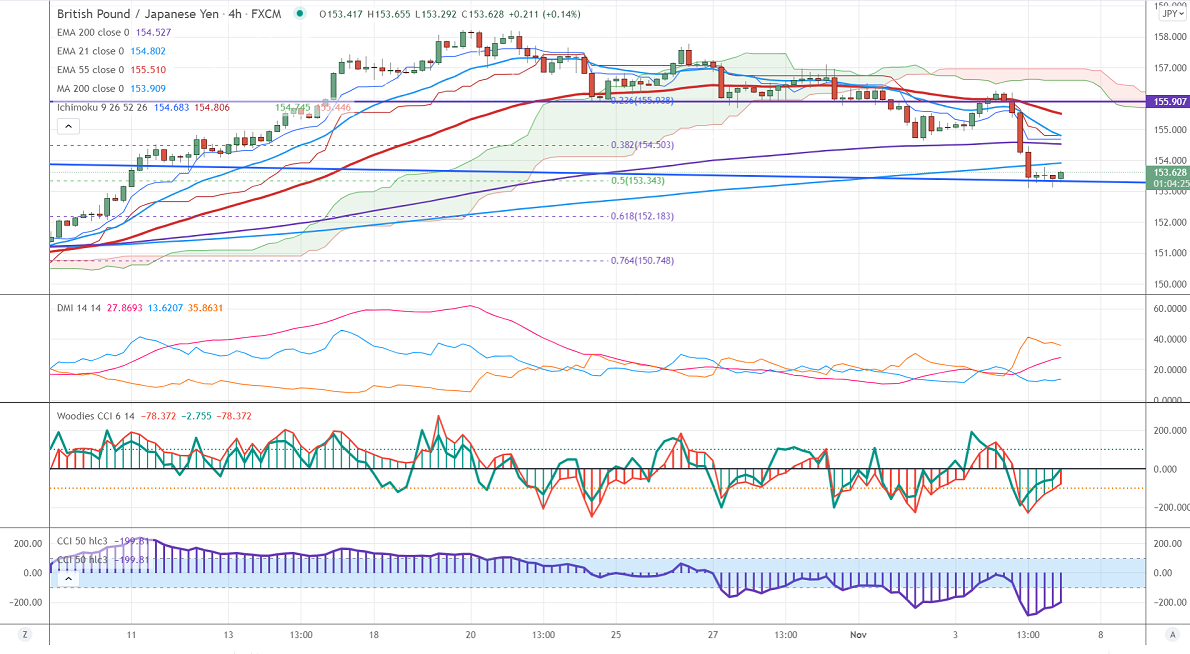

Major Intraday resistance -153.75

Intraday support- 153

GBPJPY declined sharply and lost more than 300 pips after the dovish BOE policy. The Pound sterling hits five-week lows against the US dollar as the Bank of England kept its rates unchanged. The central bank monetary policy committee voted 6-3 in favor of continuing bond purchase. The overall trend is still bearish as long as resistance 155 holds. It hits a low of 153.12 and is currently trading around 153.51.

.

USDJPY- Analysis

The pair is witnessing a range-bound trade after Fed monetary policy. Any breach below 113 targets 112/111.

CCI Analysis-

The CCI (50) and Woodies CCI are holding below zero level in the 4-hour chart. This confirms the weak trend. Bearish trend confirmed.

Technical:

The immediate resistance is around 153.75, any break above targets 154.55/155. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is around 153. Any indicative violation below targets 152.18/151.60.

Indicator (4-Hour chart)

Directional movement index –Bearish

It is good to sell on rallies around 153.75-80 with SL around 154.50 for a TP of 151.