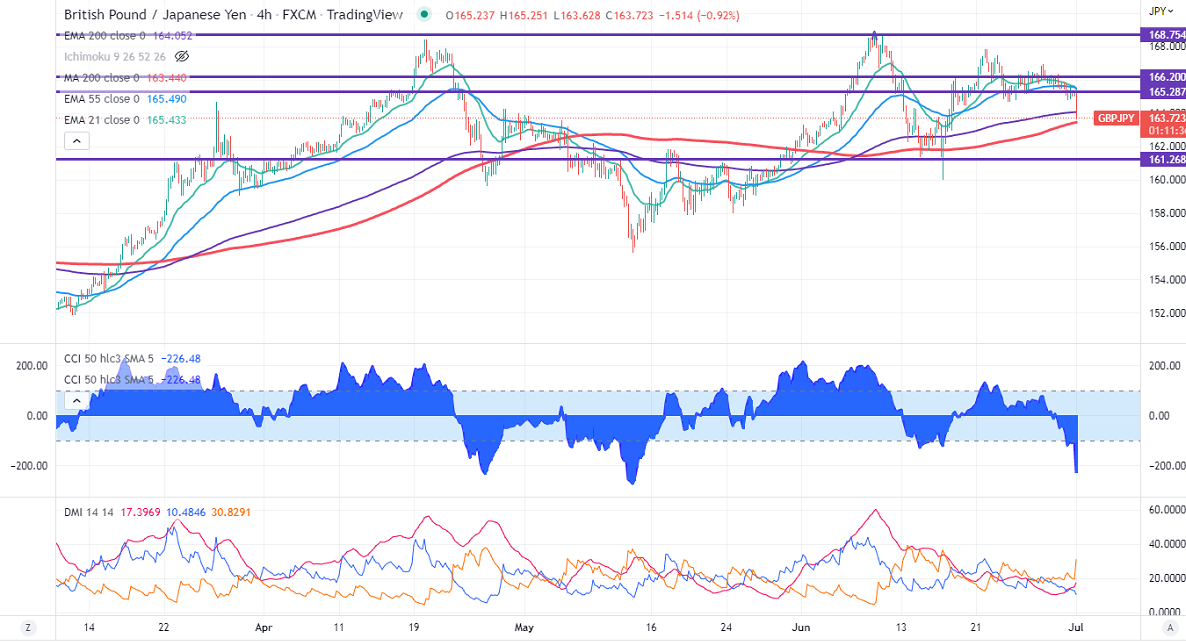

GBPJPY lost more than 100 pips in today's Asian session on a strong yen. The minor sell in pound sterling from yesterday's high of 1.21880 after BOE Governor's cautious tone in ECB annual forum. Any close below 1.2100 confirms a bearish continuation. Technically in the 4-hour chart, the pair is holding below 21-EMA, 55 EMA, and above long-term 200 EMA (164.05). Any break below 163.60 will drag the pair down to 163/160. GBPJPY hits an intraday low of 163.72 and is currently trading around 163.72.

The near-term resistance is around 164.65, any breach above targets 165.52/166.35/167/167.85/168.75.

Indicators (4-hour chart)

CCI (50) - Bearish

ADX- Bearish

It is good to sell on rallies around 163.85-90 with SL around 164.65 for TP of 162.