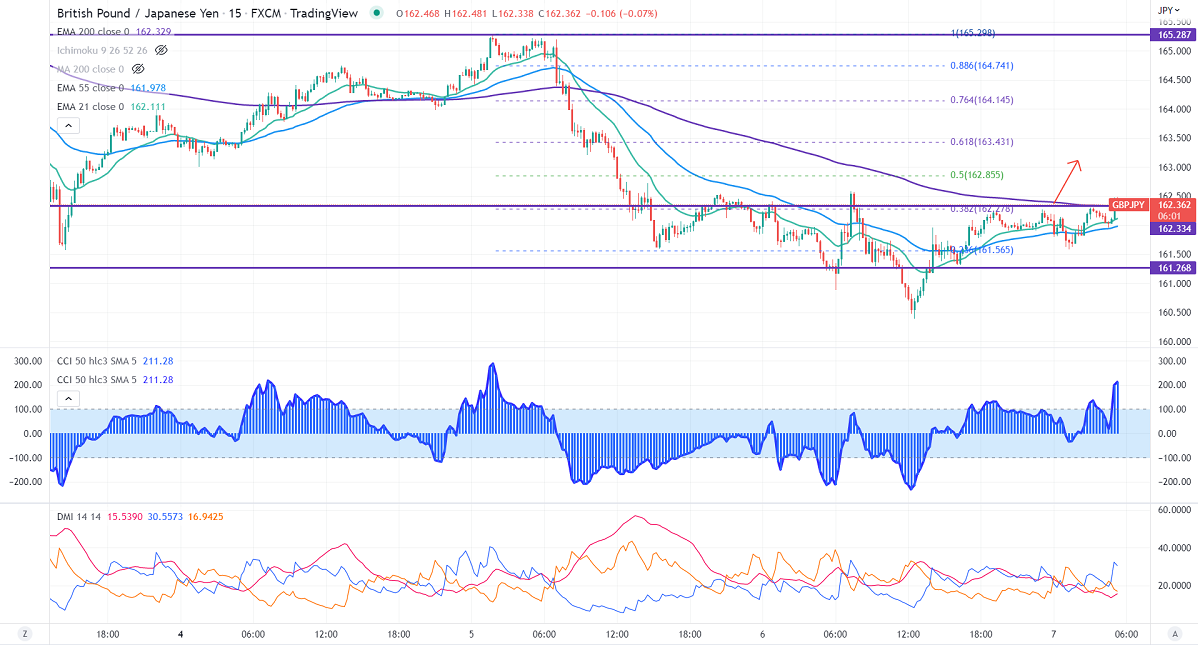

GBPJPY has formed a double bottom near 160 and shown a recovery on minor bullishness in Pound sterling. Technically in the 15 min chart, the pair is holding above short term (21- and 55 EMA) and below 200 EMA (162.33). Any break above 162.35 will take the pair to 163/163.45/164. GBPJPY hits an intraday high of 162.179 and is currently trading around 162.15.

The near-term support is around 161.50, any breach below targets 160/158.

Indicators (15-Min chart)

CCI (50)- Bullish

ADX- Neutral

It is good to buy above 162.35 with SL around 161.80 for TP of 163.35/164.