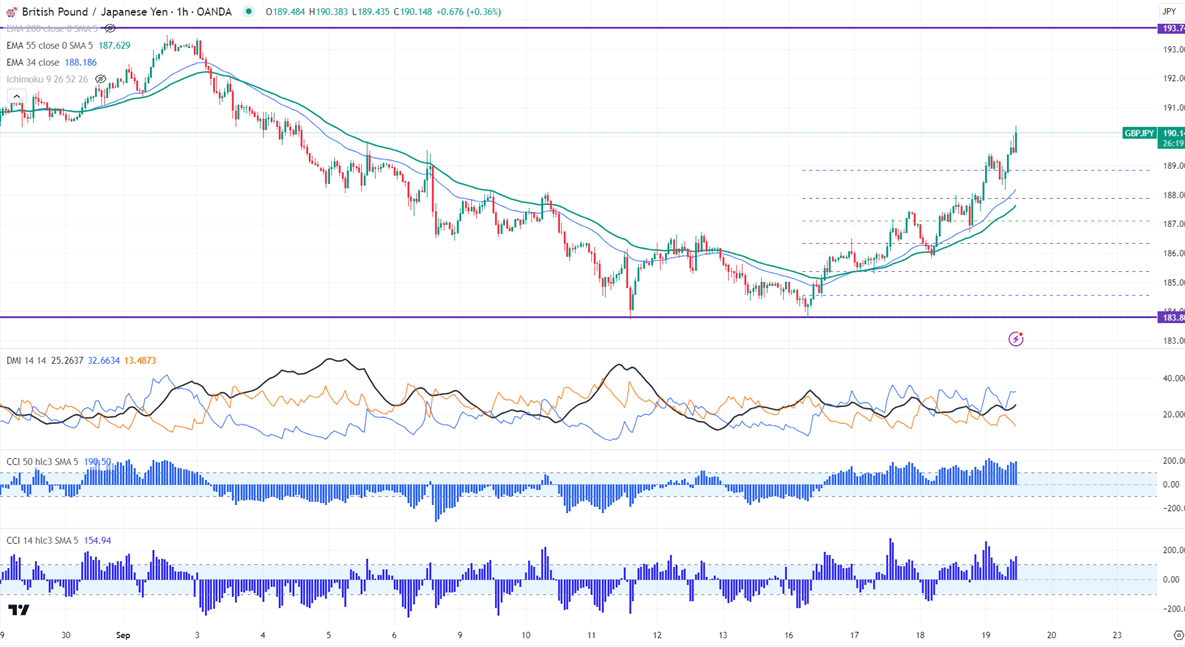

GBPJPY surged above 190 after the hawkish rate cut by BOE. It hit a high of 190.38 and is currently trading around 190.32. Intraday trend is bullish as long as support 188 holds.

BOE kept its rates unchanged at 5% as expected. The MPC voted by a majority of 8–1 to maintain Bank Rate at 5%. One member preferred to reduce Bank Rate by 0.25 percentage points, to 4.75%.

Technicals-

The pair is trading above short-term 34, below 55 EMA (187.19 and 186.88), and long-term 200 EMA (189.81) in the 4-hour chart.

The near-term resistance is around 190.50, a breach above targets 191.25/192/193.50. Major trend continuation only above 193.50. The immediate support is at 189.50, any violation below will drag the pair to 188.85/188/187.50.

Indicator (4-hour chart)

CCI (14)- Bullish

CCI (50)- Bullish

Average directional movement Index - Bullish. All indicators confirm a bullish trend.

It is good to buy on dips around 189.70-75 with SL 188.85 for a TP of 193.45.