At spot WTI oil reference: $46.89, the hedger who is dubious about bearishness on this energy commodity can execute put spread by initiating following trades.

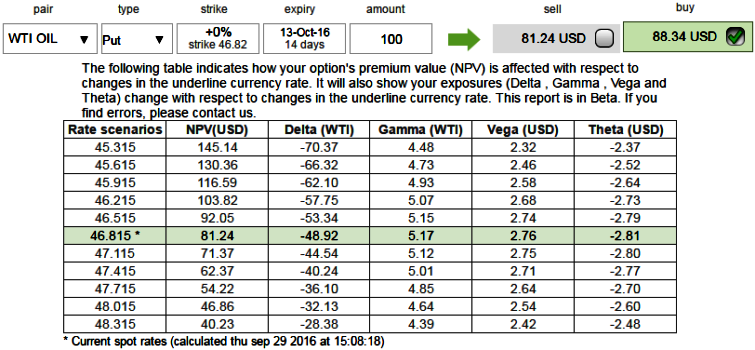

Contemplating prevailing consolidation pattern of WTI crude price, construct option strategy as shown below,

Stay long a Dec’16 WTI 47-40 put spread, markets have rallied on anticipation of a deal in Algiers next week. We continue to view this as unlikely, even though some progress towards a deal has been evident this week.

Furthermore, the improvement in WTI spreads signals a belief that US crude markets are improving even though the weekly data seems to have large inconsistencies in it, given the reported stock change is materially different from the calculated one.

We continue to prefer holding a short position, but one that caps our downside at the cost of the initial premium.

For fresh hedgers, earlier portfolio (long a Dec’16 $45-$40/bbl WTI put spread), should now be rebalanced by adjusting the strikes at 47-40.

In the Sensitivity table, Gamma shows how much the Delta will change if the underlying rate moves by 1%. A smaller Gamma means the Delta is less likely to change as the underlying market moves. In the diagram, we’ve shown the 2w ATM puts and its sensitivities, one can understand that ITM puts would have decent gamma comparatively.

The US West Texas Intermediate (WTI) crude for November delivery on the NYME rose 0.15% to $47.12 a barrel.

The U.S. WTI oil prices held gains in early Asian trading session Thursday as OPEC agreed to curbs on production with details apparently still under discussion.

OPEC surprised Wednesday and agreed to production curbs under a formula to cut output to a range of 32.5 million to 33 million barrels of oil per day from 33.4 million.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed