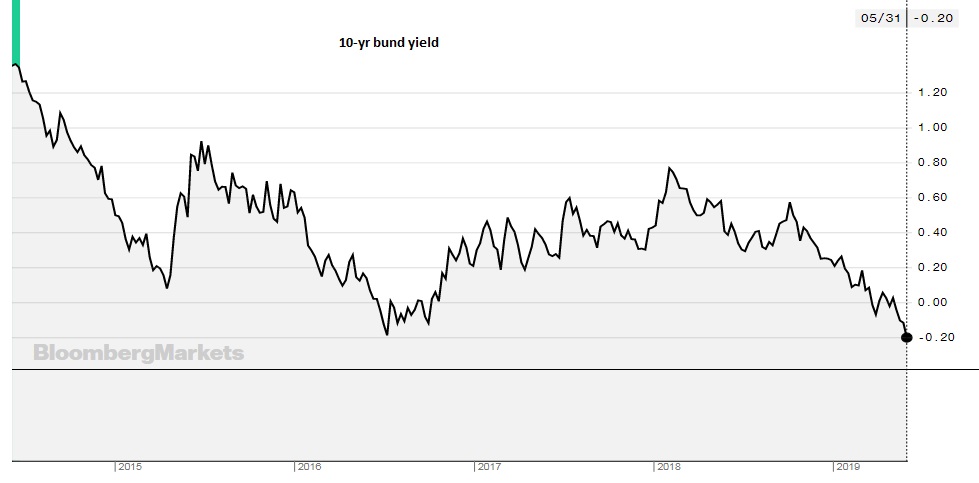

Amid risk aversion stemming from Sino-American trade dispute, where both parties have engaged in a tariff battle, German 10-year bund price has reached a fresh record high, while yields dropped to a record low. The 10-yr bund future is currently trading at 168.4 area, while the 10-yr yield has dropped to a new low of -0.23 percent, surpassing the previous bottom of -0.19 percent made in 2016. German 30-yr yield is at 41 bps, just shy of a record low of 34 bps.

The current geopolitical tensions and the recent decline in the global stock market are fueling a run for safe-haven assets. As German yields decline, the safe haven metal gold is up more than 5 percent.

Moreover, dovish speculation on the monetary policy front is contributing to declining bund yields. The European Central Bank (ECB) ended its asset purchase program last year in December and has so far avoided discussing further monetary easing, however, the market is pricing rate cuts by the central bank.

Trade idea:

Our calculations suggest that the price of bund would rise further, while yields drop. We expect the 10-yr bund future to reach the following targets - 169.3, 170.6, and 171.5.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed