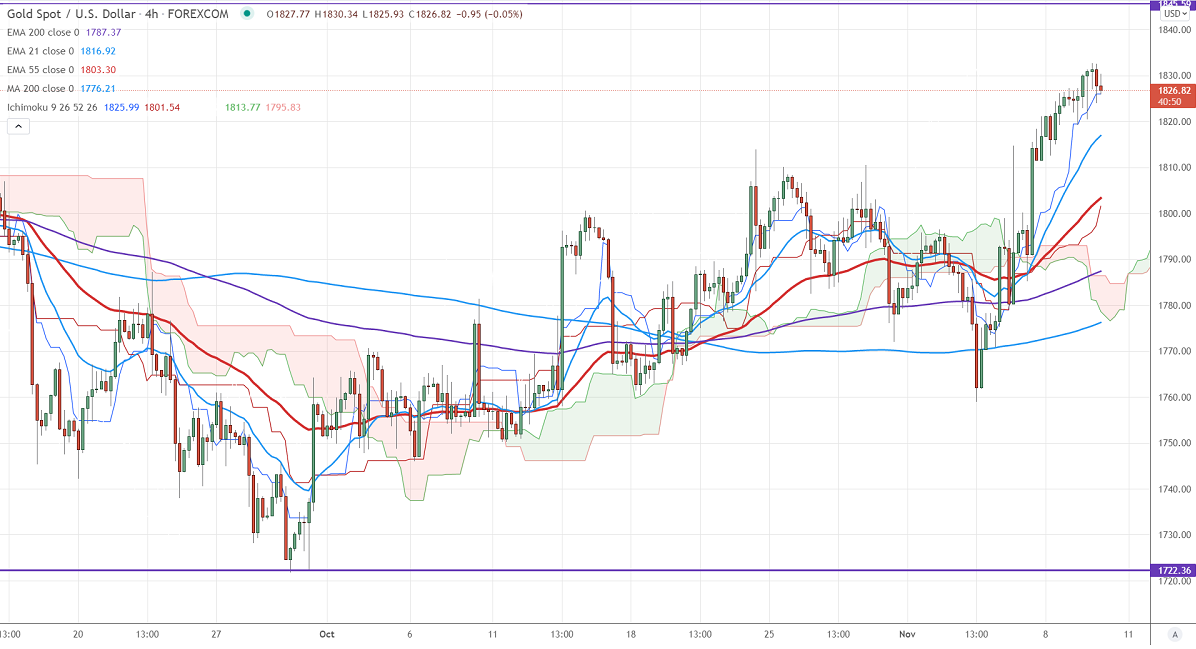

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1825.98

Kijun-Sen- $1797.26

Gold surged slightly after US PPI data. It rose 0.6% in October in line with a forecast of 0.6%. The yearly PPI increased 8.6%, the highest annual pace in 11 years. The US dollar index is trading in a narrow range between 93.87 and 94.15 for the past day. Any close above 94.50 confirms further bullishness. The minor sell-off in US treasury yields also supported the yellow metal. Gold hits a high of $1832.75 and is currently trading around $1826.82.

Factors to watch for gold price action-

Global stock market- Slightly bullish (negative for gold)

US dollar index –Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

It faces strong support at $1800 violation below targets $1780/$1760/$1750$1740. Significant trend continuation only below $1675. The yellow metal is facing resistance at $1835, any break above will take the yellow metal to $1860. The major bullish trend after it breaks $1835.

It is good to buy on dips around $1800 with SL around $1780 for TP of $1860.