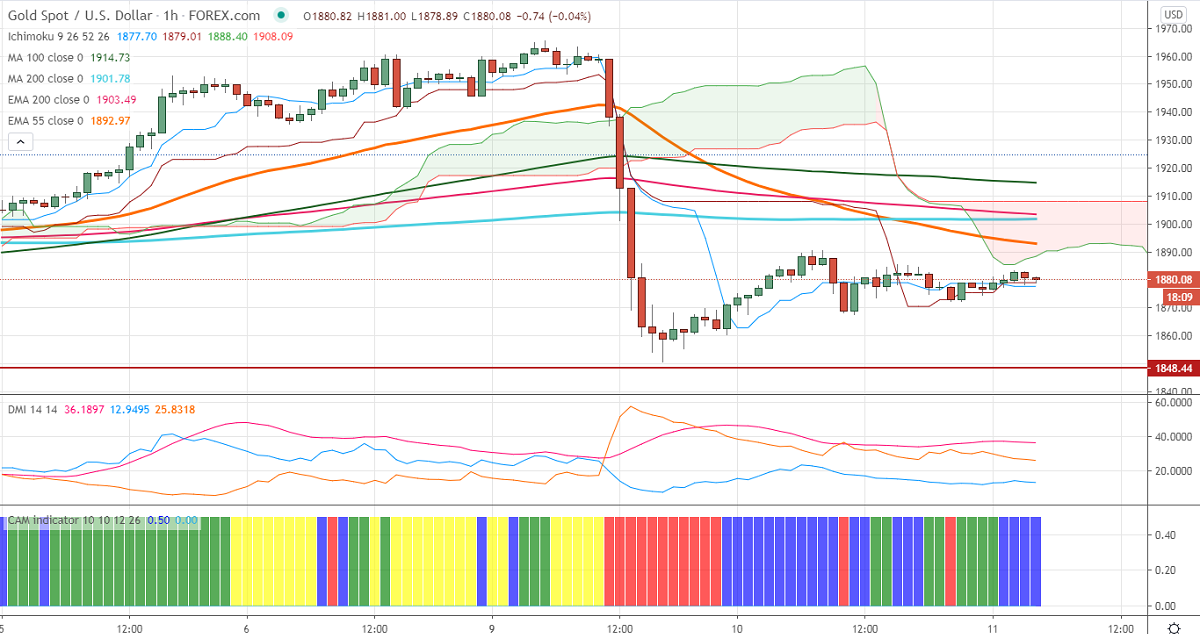

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1877

Kijun-Sen- $1878

Gold continues to trade below $1900 on vaccine optimism and rising US bond yield. U.S has planned to supply the COVID-19 vaccine if Pfizer submits positive data from its vaccine trial. The dollar index has once surged after a minor jump to 92.97. Any violation above 93 confirms bullish continuation. The US 10-year yield is trading higher and hits the highest level since March on vaccine news.

Technical:

In the daily chart, Gold is facing strong support at $1848 (Sep 24th low). Any break below will take the pair till $1832/$1800/$1781. On the higher side, near term resistance is around $1900 and any indicative break above that level will take till $1920/$1931/$1950.

It is good to sell on rallies around $1908-10 with SL around $1930 for the TP of $1848/$1832.