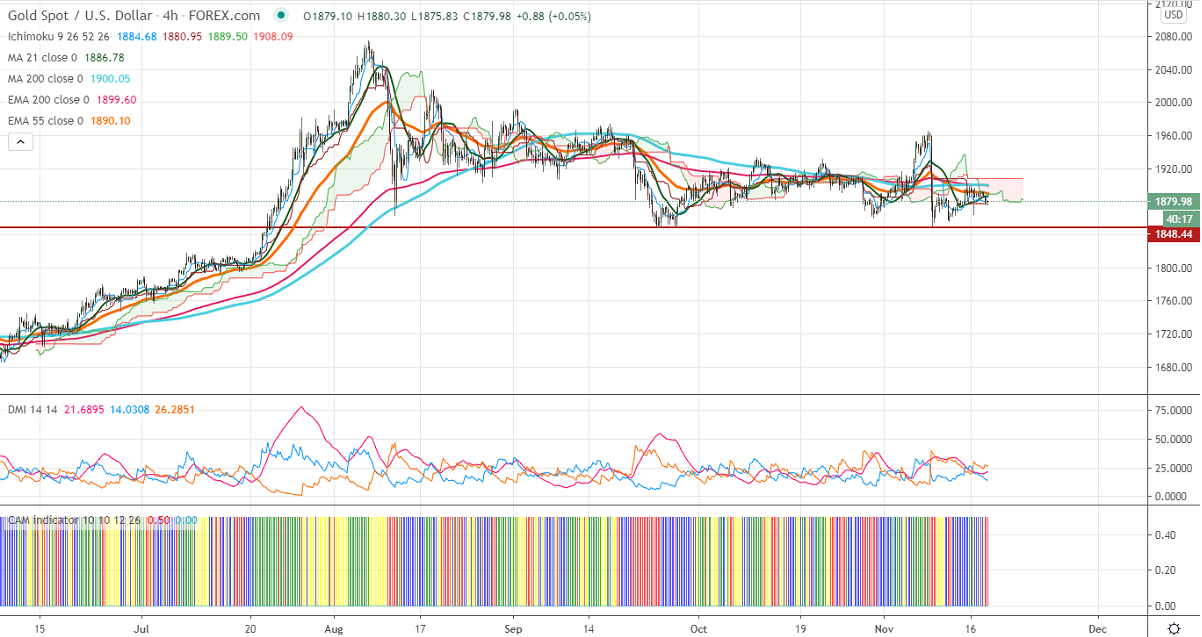

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1886

Kijun-Sen- $1880.55

Gold is trading lower on COVID-19 vaccine optimism. The positive trial data by Pfizer and Moderna Inc is putting pressure on Safe-haven demand. The dollar index is trading weak, a dip till 92 is likely. The US 10-year yield lost nearly 15% after hitting a multi-month high.

Economic data:

The US retails sales came at 0.3% for October well below the estimate of 0.5%. Markets eye US Building permits, housing starts for further direction.

Technical:

In the 4-hour chart, Gold upside capped by 200 MA, any violation above $1900 targets $1920/$1935. On the lower side, near term support is around $1860 and any indicative break below that level will take till $1848/$1830.

It is good to sell on rallies around $1898-1900 with SL around $1921 for the TP of $1849.