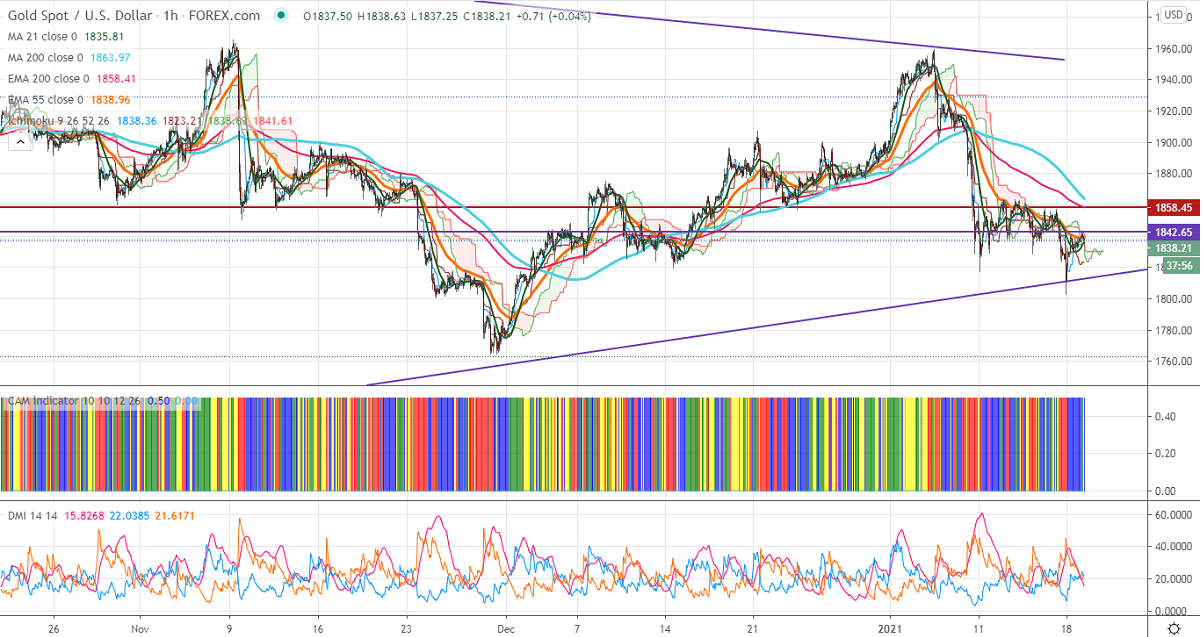

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1838

Kijun-Sen- $1823

Gold has taken support near $1800 and shown a minor recovery till $1843. The slight weakness in the US dollar index and dip in US 10-year yield is supporting the yellow metal at lower levels. The minor trend reversal can happen if it breaks above $1865 (200-H MA). US dollar index's significant bullishness only if it breaks 91 levels.

Technical:

It is facing strong support at $1823, violation below targets $1818 (61.8% fib)/$1800. Major trend reversal only below $1800.On the higher side, near term resistance is around $1845, any indicative break above that level will take till $1865/$1874/$1880.

It is good to buy on dips around $1815-16 with SL around $1800 for the TP of $1880.