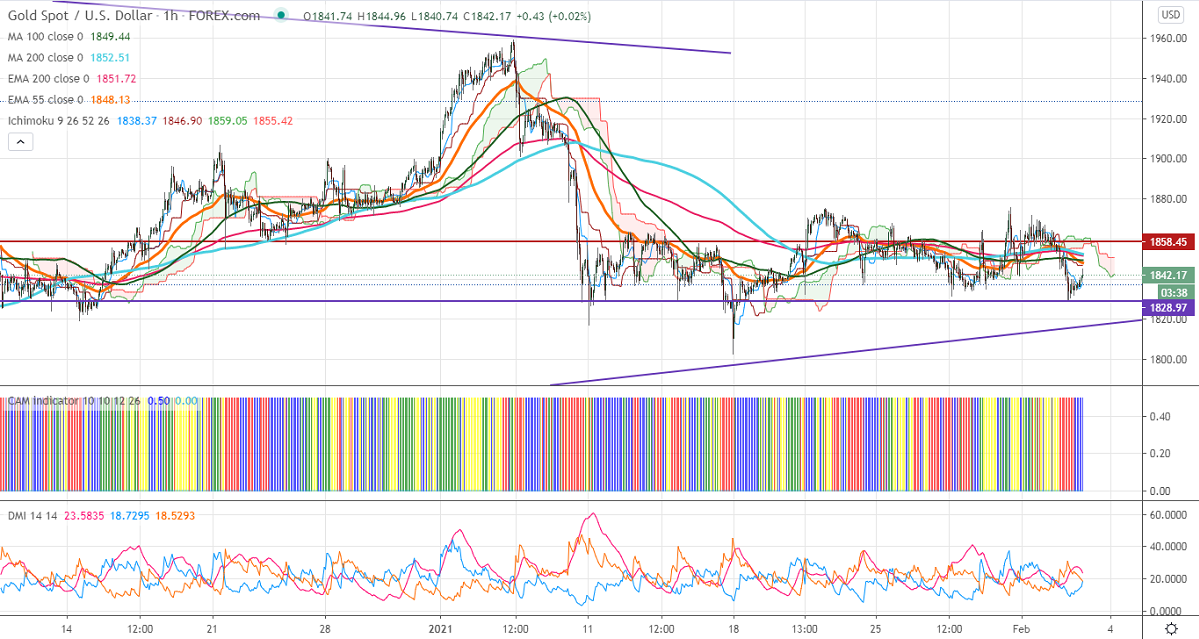

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1836.77

Kijun-Sen- $1846.90

Gold has formed a triple bottom around $1831 in the hourly chart and shown a minor recovery. The yellow metal lost more than $30 on strong US dollar. DXY has broken significant resistance 91 levels after a long consolidation. The US 10-year yield recovered more than 10% from a low of 0.998%. Markets eye US ADP employment and US ISM services PMI data for further direction.

Technical:

It is facing strong support at $1830, violation below targets $1820/$1800.On the higher side, near term resistance is around $1850, any indicative break above that level will take till $1865/$1885.

It is good to sell on rallies around $1852-53 with SL around $1865 for the TP of $1802.