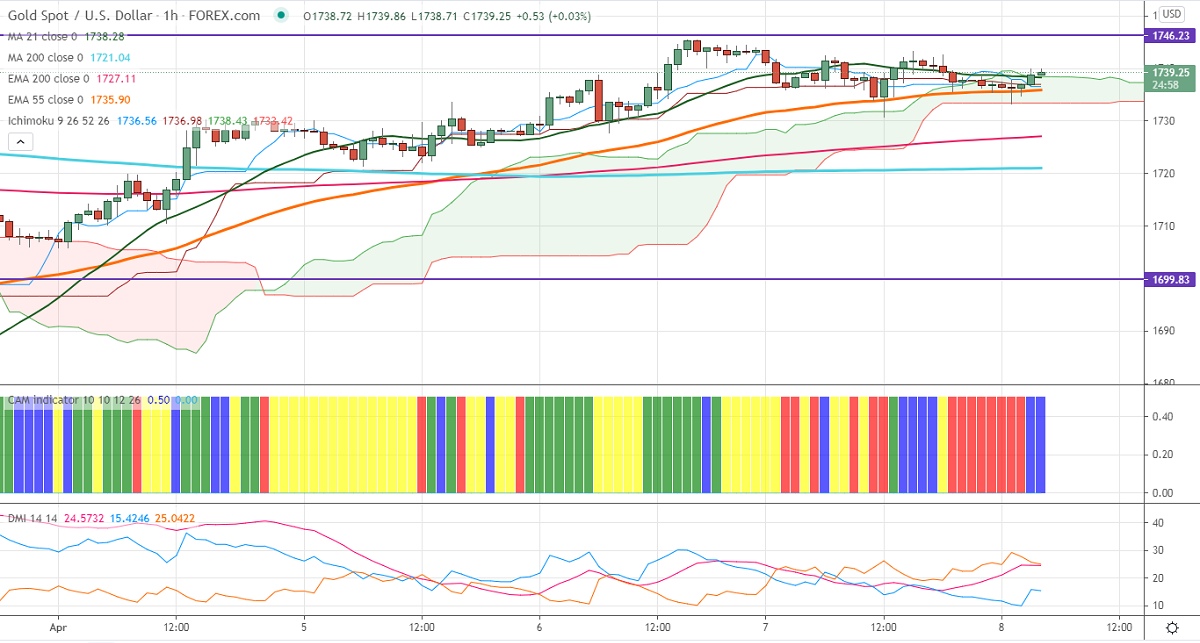

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1736.95

Kijun-Sen- $1736

Gold is consolidating in a narrow range between $1745 and $1730 for the past three days. The FOMC meeting minutes confirms that Fed will continue its accommodative policy stance until inflation and employment target achieved. DXY has shown a minor pullback from a low of 92.13 the minor recovery in the US 10- year yield is preventing the yellow metal from further upside.

Economic data:

Major economic data to be released are US initial jobless claims for further minor reaction.

Technical:

It is facing strong support at $1730, violation below targets $1719/$1700. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1745, any indicative break above that level will take till $1760/$1783.

It is good to buy above $1745 with SL around $1730 for the TP of $1780.