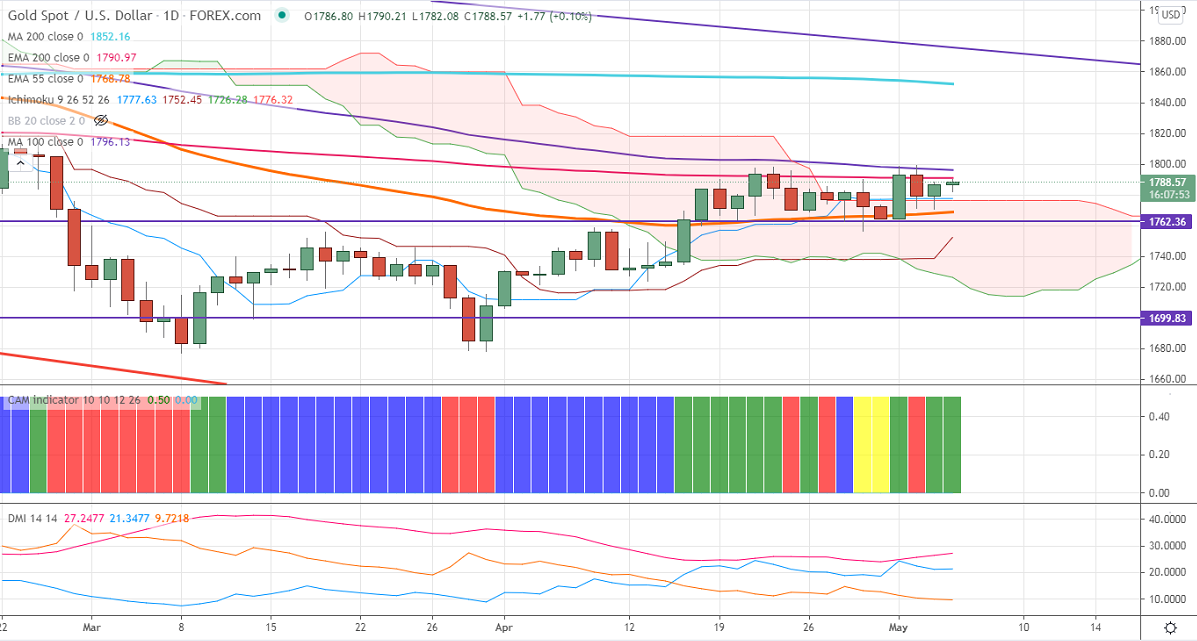

Ichimoku analysis (Daily chart)

Tenken-Sen- $1737

Kijun-Sen- $1821

Gold has formed a double bottom around $1770 and shown minor recovery. The minor sell-off in US bond yields is supporting the yellow metal. The short-term trend is still neutral as long as resistance $1802 holds. The pullback in the US dollar index is putting pressure on gold at higher levels. Any violation above 91.50 confirms a minor trend reversal. The yellow metal hits a high of $1790 and is currently trading around $1788.29.

Economic data:

The number of private-sector jobs rose to 742000 in Apr compared to a forecast of 872K. The US ISM services PMI came at 62.7% in Apr slightly below the estimate of 64.2.

Technical:

It is facing strong support at $1769, violation below targets $1760/$1748. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1802, any indicative break above that level will take till $1821/$1832.

It is good to buy on dips around $1770 with SL around $1760 for the TP of $1802.