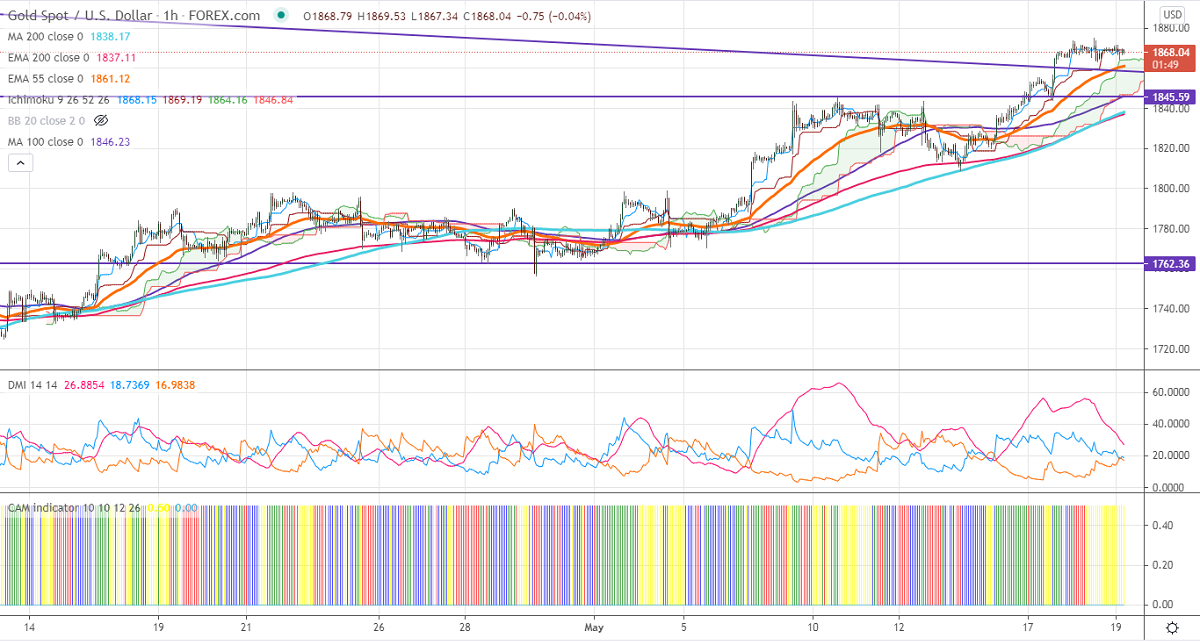

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1868

Kijun-Sen- $1869

Gold is consolidating after hitting a multi-month high at $1875. The broad-based US dollar weakness is supporting the yellow metal at a lower price. Dollar index staying well below 90 levels and to retest 89.20 (Jan 6th 20921 low). Markets eye US Fed FOMC minutes meeting for further direction. The Fed is expected to maintain its dovish stance and interest rates, bond purchase unchanged. The yellow metal hits an intraday high of $1871.14 and is currently trading around $1870.85.

Technical:

It is facing strong support at $1860, violation below targets $1850/$1845/$1838. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1875, any convincing break above confirms bullish continuation. A jump to $1900/$1932 is possible.

It is good to buy on dips around $1861-62 with SL around $1850 for the TP of $1898.