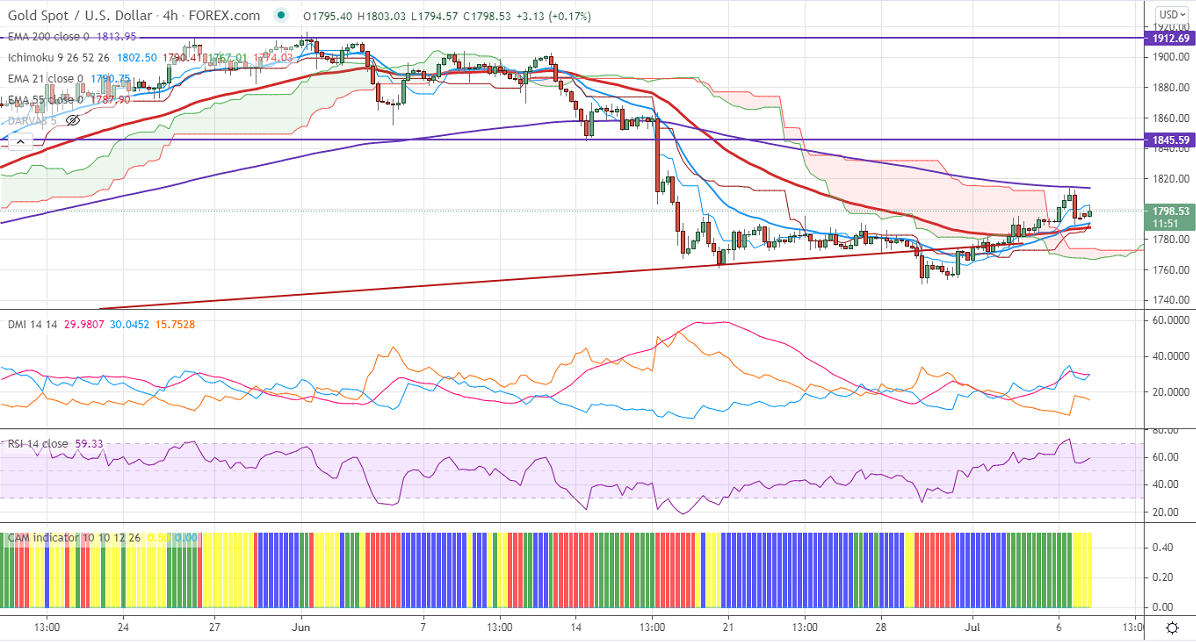

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1802

Kijun-Sen- $1785

Gold is holding above $1800 despite the strong US dollar. The services PMI contracted to 60.1 in June compared to a forecast of 63.40. Markets eye FOMC minutes meeting today for further direction. DXY is struggling to break the previous week's high 92.74. Any breach above confirms trend continuation. The US 10- year yield declined more than 6%, hits the lowest since Feb. The yellow metal hits a high of $1815 yesterday and is currently trading around $1798.

Technical:

It is facing strong support at $1780, violation below targets $1773/$1768/$1753. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1815, any convincing break above will take the yellow metal to $1836/$1860 is possible.

It is good to buy on dips at $1790 with SL around $1780 for the TP of $1835.