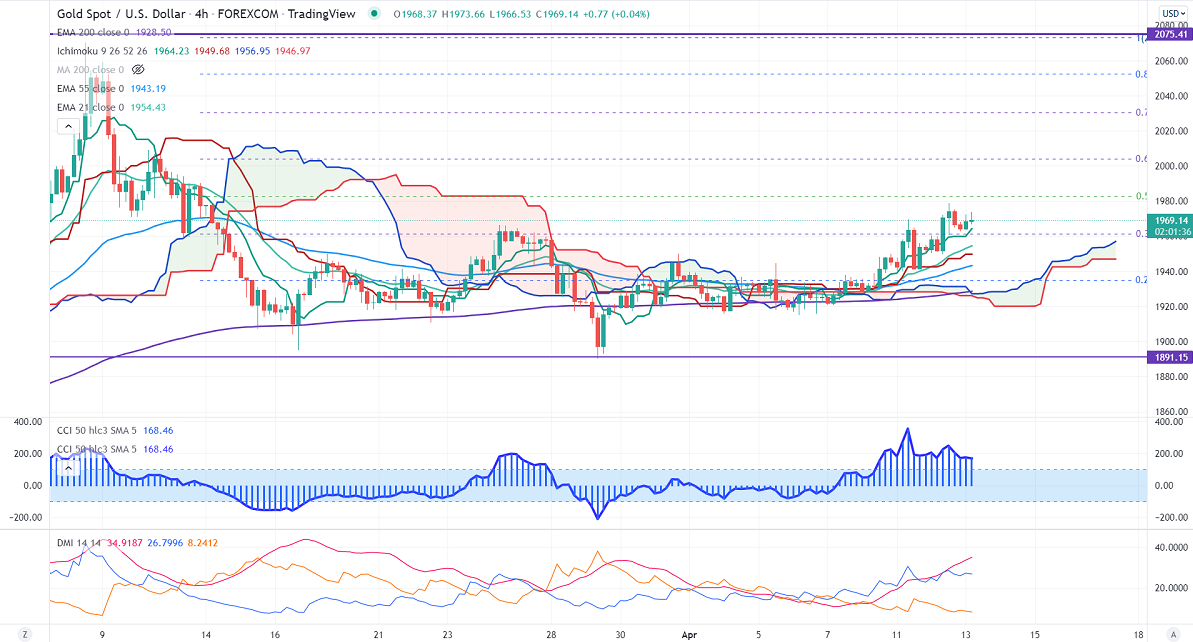

Ichimoku Analysis (4 hour chart)

Tenken-Sen- $1959.83

Kijun-Sen- $1949.83

Gold hits fresh monthly high after upbeat US CPI. It jumped to a four-decade high of 8.5% for March compared to a forecast of 8.4%. While core CPI came at 6.5% vs. an estimate of 6.7%. The US dollar index broke the previous week's high of 100.18 and trades above that level. The geopolitical tension between Russia and Ukraine supports the yellow metal at lower levels. The yellow metal hits a high of $1973.95 and is currently trading around $1968.10.

Factors to watch for gold price action-

Global stock market- weak (Positive for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1950, breach below confirms the intraday bearish trend. A dip to $1940/$1925/$1910/$1900/$1890. Significant reversal only below $1890. The yellow metal faces strong resistance of $1970, any breach above will take to the next level $1982/$2000/$2020.

It is good to buy on dips around $1950-51 with SL around $1930 for TP of $2000.