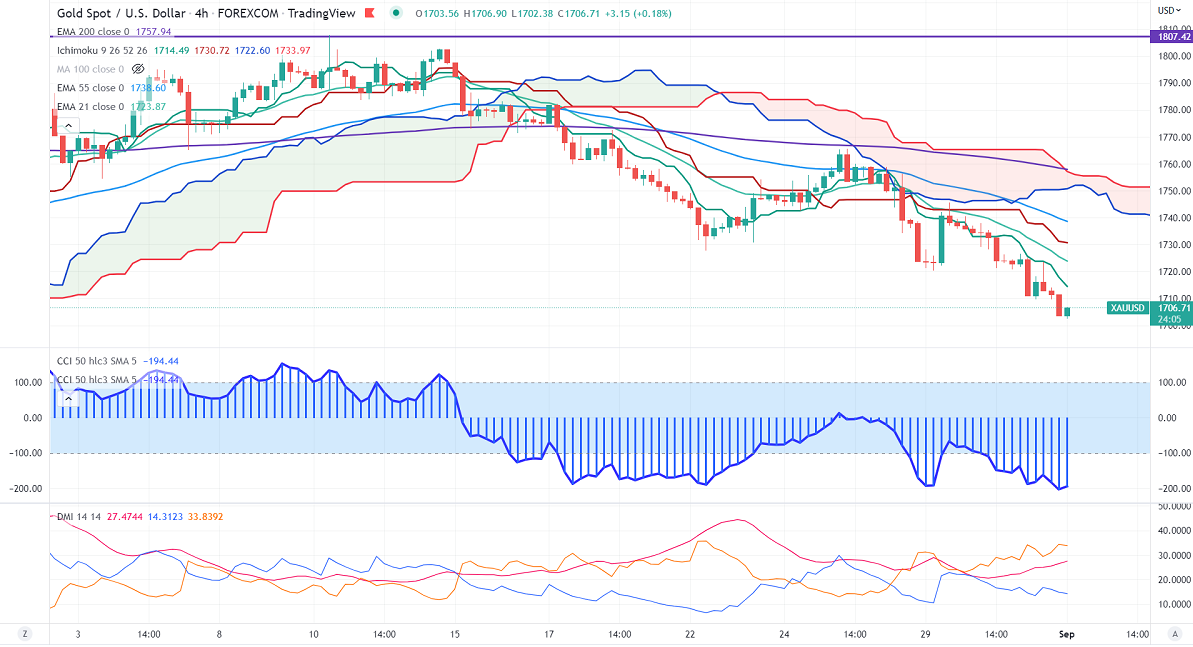

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- $1718

Kijun-Sen- $1731.25

Gold price is trading lower despite the weak US dollar. Hawkish comments from major central banks put pressure on the yellow metal at higher levels. Eurozone consumer prices surged to 9.1% in August compared to a forecast of 8.9% also increasing the chance of a rate hike by the ECB.

US private payrolls have added 132000 jobs in Aug below expectations of 300000.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Sep rose to 73% from 64% a week ago.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index – Bearish (Positive for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1700, a breach below targets $1650/$1600. Significant reversal only below $1650. The yellow metal faces minor resistance around $1720, breach above will take it to the next level of $1740/$1760/$1775/$1800/$1820.

It is good to sell on rallies around $1728-30 with SL at around $1750 for TP of $1650.