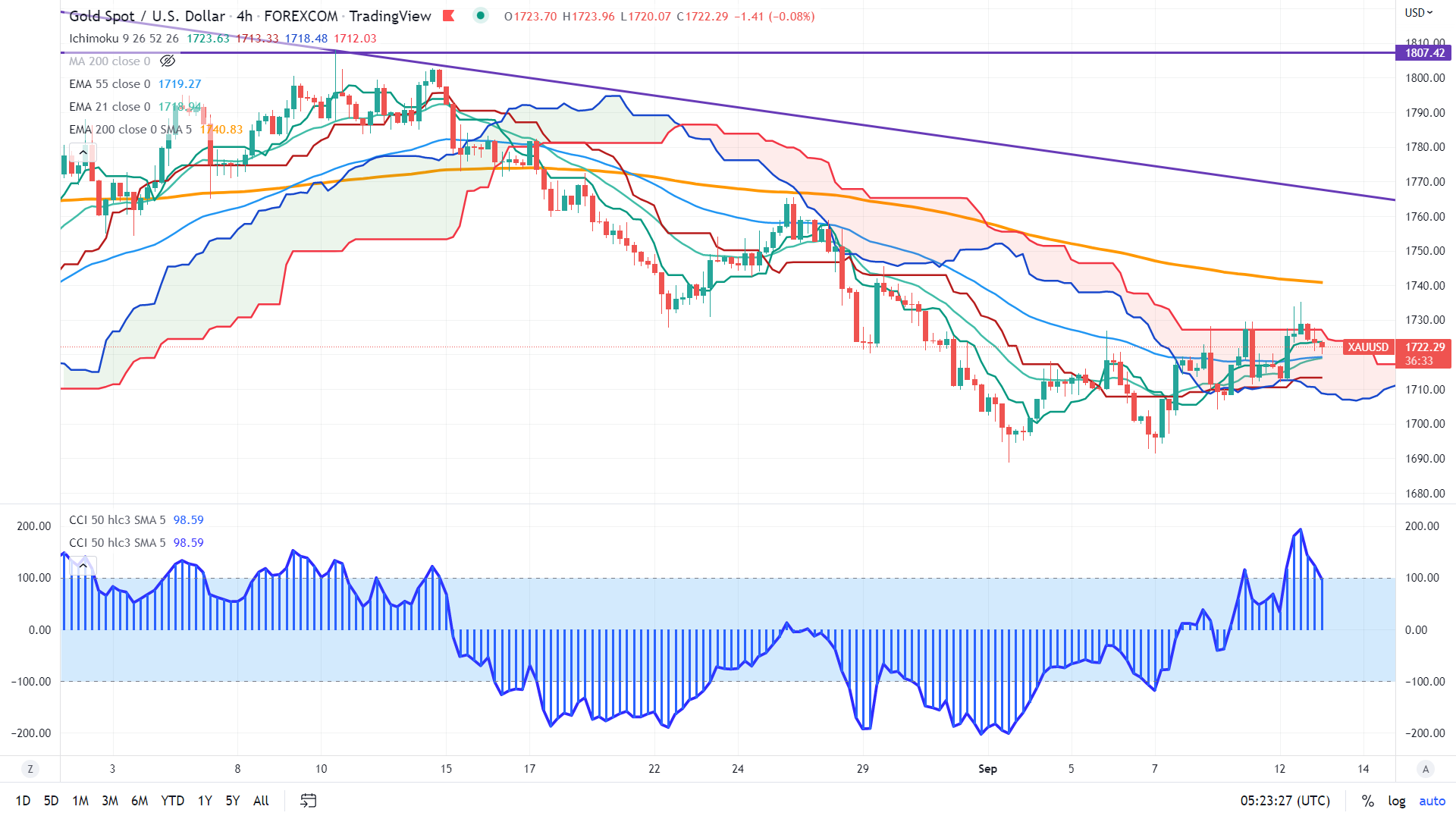

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1712.03

Kijun-Sen- $1748.38

Gold pared some of its gains on surging US treasury yields. Markets eye US CPI data for further direction. Headline CPI is expected to decline by -0.1%, core inflation to rise by 0.30% mom. The overall trend is still bullish as long as support of $1680 holds.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Sep rose to 88% from 57% a week ago.

Factors to watch for gold price action-

Global stock market- Bullish (positive for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1690, a close below targets $1671/$1650/$1600—significant reversal only below $1650. The yellow metal faces minor resistance around $1720, breach above will take it to the next level of $1740/$1760/$1775/$1800/$1820.

It is good to buy on dips around $1678-80 with SL at around $1650 for TP of $1750/$1775.