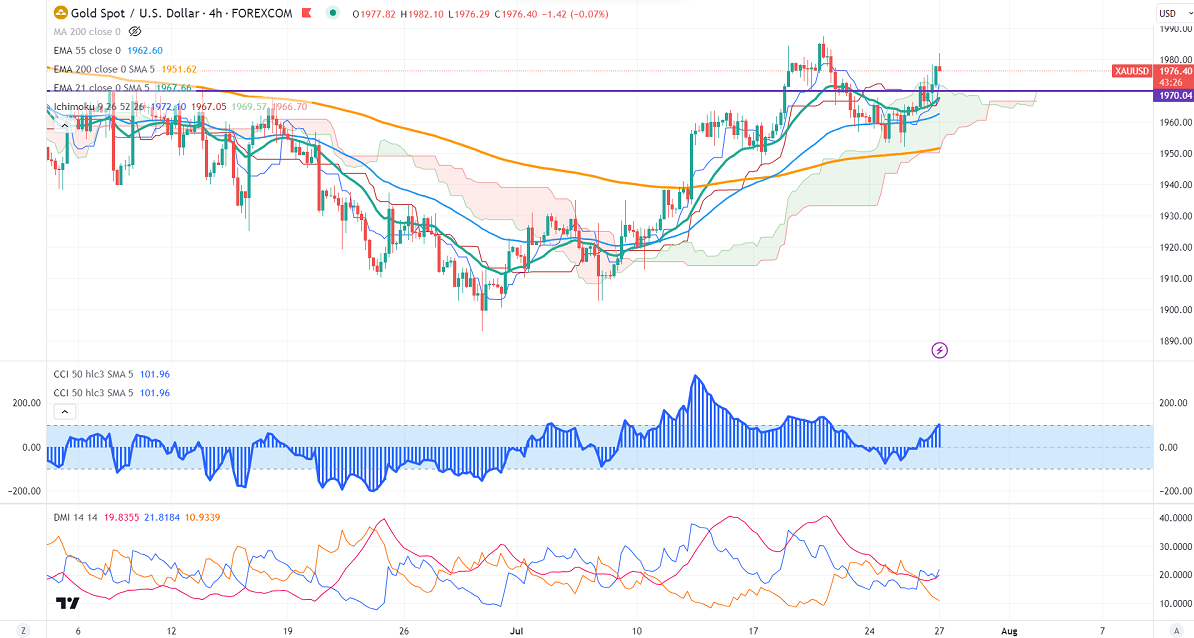

Ichimoku Analysis (4- Hour chart)

Tenken-Sen- $1965.19

Kijun-Sen- $1965.19

Gold prices recovered after Fed monetary policy. It hits a high of $1987 yesterday and currently trading around $1978.59.

US Fed hiked rates by 25 bpbs to 5.5% as expected. The central bank said that the economy is expanding at a moderate pace. Jobs gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated. The statement is like a carbon copy of June's with minor changes.

Jul 27th, 2023, ECB Monetary policy (12:15 pm GMT)

US advance GDP and US durable goods order (12:30 pm GMT)

US dollar index- Bullish. Minor support around 100.60/99.50. The near-term resistance is 102/103.

According to the CME Fed watch tool, the probability of a no-rate hike in Sep increased to 78% from 0% a day ago.

The US 10-year yield pared some of its gains after a less hawkish rate hike by the fed. The US 10 and 2-year spread narrowed to -97% from -110%.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index - Bullish (bearish for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1970, a break below targets of $1960/1950. The yellow metal faces minor resistance around $1980, and a breach above will take it to the next level of $2000/$2020.

It is good to buy on dips around $1960 with SL around $1950 for TP of $1990/$2000.