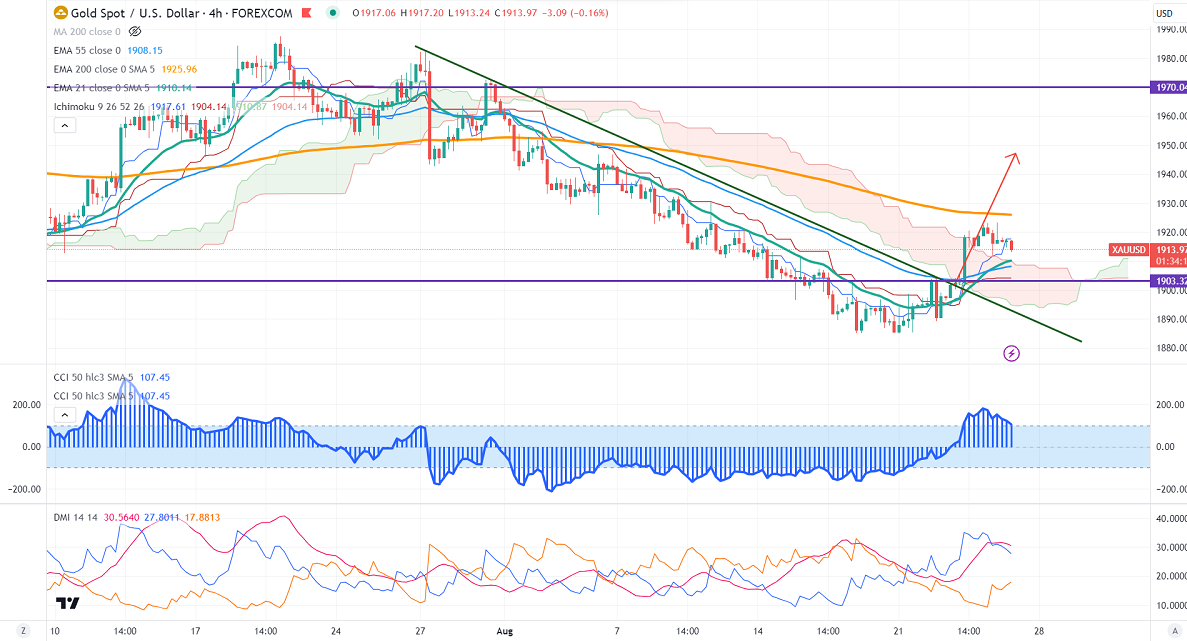

Ichimoku Analysis (4- Hour chart)

Tenken-Sen- $1904.82

Kijun-Sen- $1902.75

Gold pared some of its gains ahead of Powell's speech at the Jackson Hole symposium. It hit a low of $1913.24 at the time of writing and is currently trading around $1913.58.

The number of people who have filed unemployment benefits the week ending Aug 19 to 23000 compared to a forecast of 239000. US durable goods orders fell 5.2% in July vs. -4 expected.

Major economic data for the day

Aug 25th, 2023, German IFO Business Climate (8:00 am GMT)

Jackson Hole Symposium Powell speech (2:05 pm GMT)

US dollar index- Bullish. Minor support around 103/102. The near-term resistance is 105/106.

According to the CME Fed watch tool, the probability of a no-rate hike in Sep decreased to 80.50% from 88% a week ago.

The US 10-year yield showed a minor jump ahead of Powell's speech. The US 10 and 2-year spread widened to -78% from -66%.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index - Bullish (bearish for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1885, a break below targets of $1847/$1820. The yellow metal faces minor resistance around $1920 and a breach above will take it to the next level of $942/$1950/$1970.

It is good to buy on dips around $1905-06 with SL around $1890 for TP of $1950/$1970.