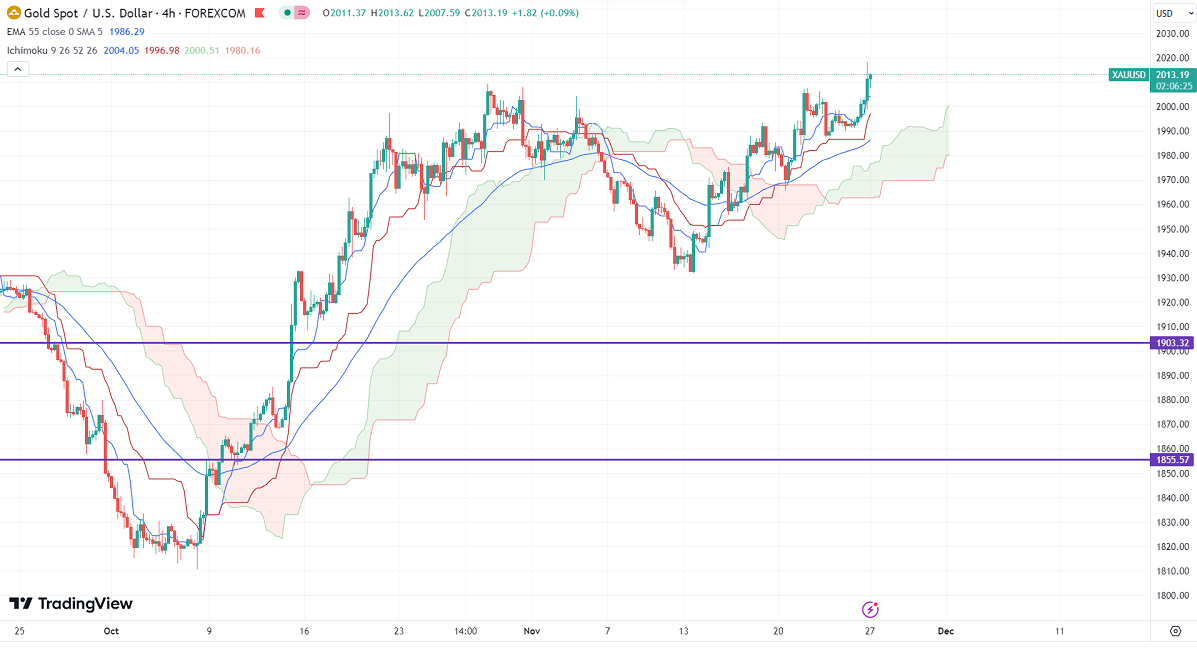

Ichimoku Analysis (4 hour chart)

Tenken-Sen- $2004.05

Kijun-Sen- $1993.56

Gold surged past $2000 on the weak US dollar. It hit a high of $2018 yesterday and is currently trading around $2010.51.

Major economic data for the week

Nov 27th, 2023, US New home sales (3:00 pm GMT)

Nov 28th 2023, S&P/CS Composite-20 HPI y/y (2:00pm GMT)

CB consumer confidence (3:00 pm GMT)

Richmond Manufacturing Index

US dollar index- Bearish. Minor support around 103/102. The near-term resistance is 104/105.

According to the CME Fed watch tool, the probability of a no-rate hike in Dec decreased to 97% from 100% a week ago.

The US 10-year yield showed a minor pullback after hitting a multi-week low. The US 10 and 2-year spread widened to -47% from -16%.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Weak (positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1980, a break below targets of $1965/$1950/$1929/$1900/$1850. The yellow metal faces minor resistance around $2020 and a breach above will take it to the next level of $2030/$2050.

It is good to buy on dips around $1980-81 with SL around $1968 for TP of $2020.