Gold is consolidating in a narrow range between $2670 and $2632 for the past two days. It hits a low of $2632 yesterday and is currently trading around $2658.

The upbeat US jobs data erased the chance of 50 bpbs by the Fed in the November meeting.

US dollar index-

The US dollar index holds above 102.50 a yield surges above 4%. Any close above 102.78 confirms a bullish continuation.

According to the CME Fed watch tool, the probability of a 25 bpbs rate cut in Nov increased to 96.90% from 46.70% a week ago.

Technical (4 hour chart)-

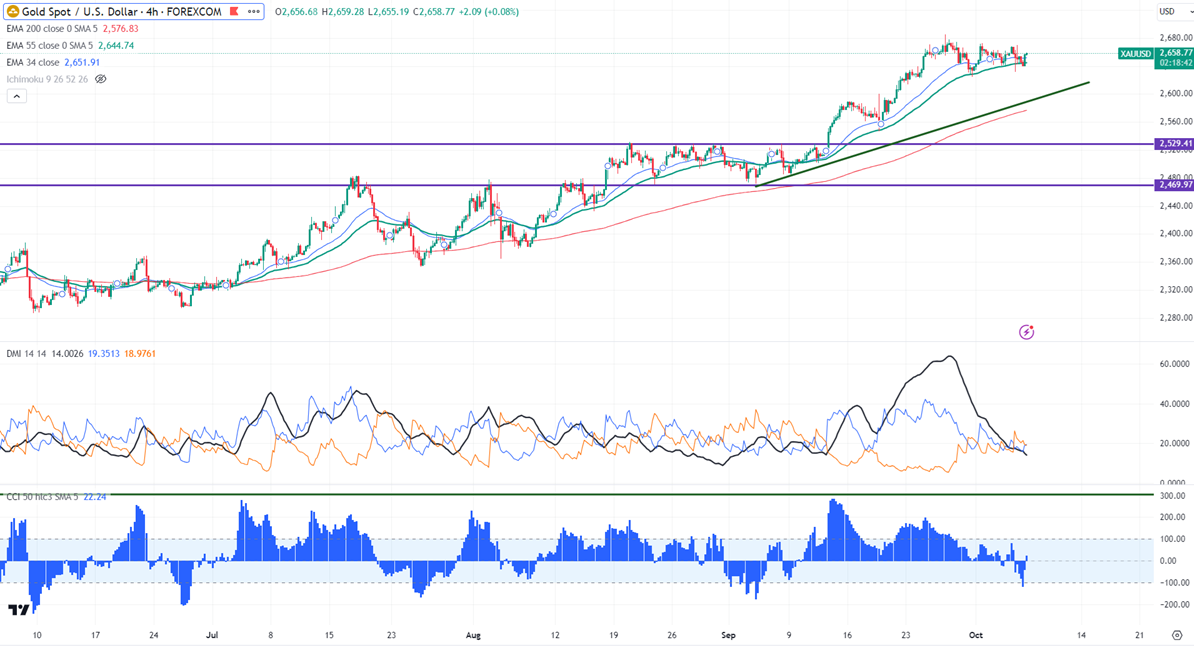

The yellow metal trades above short-term (34 and 55 EMA ) and long-term (200- EMA) in the 4- hour chart.

The near–term support is around $2640, a break below targets $2624/$2610/$2600/$2570/$2560/$2545/$2520/$2470. Major bearish continuation only below $2470.The yellow metal faces minor resistance around $2670 and a breach above will take it to the next level of $2689/$2700.

Indicator (4- hour chart)

CCI (50)- Neutral

Average directional movement Index - Neutral

It is good to sell on rallies around $2659-60 with SL around $2675 for a TP of $2600.