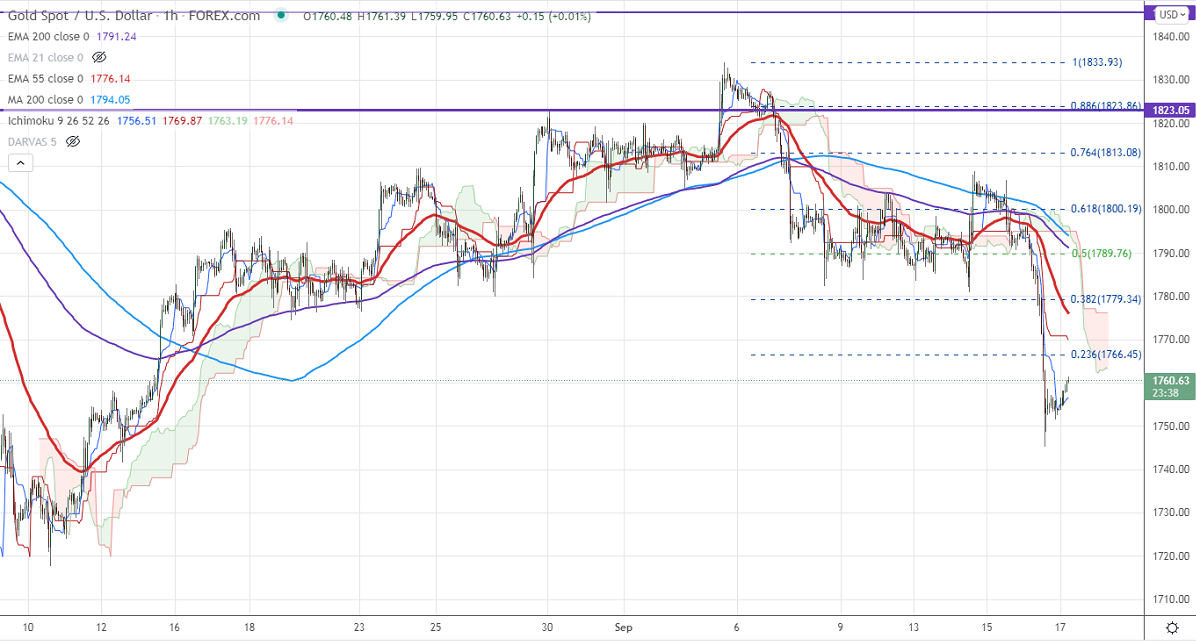

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1770

Kijun-Sen- $1778

Previous week High- $1830.33

Previous week low- $1782

Gold continuing its downtrend and shown a massive sell-off after the upbeat US retails sales data. The US dollar index regained sharply and hits three week high. The US headline retail sales rose by 0.7% in Aug compared to an estimate of -0.7%. The number of people who have filed for unemployment benefits jumped by 20000 to 332000 for the week ended September. It hits a low of $1745 and is currently trading around $1759.88.

Factors to watch for gold price action-

Global stock market- Weak (positive for gold)

US dollar index – Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The immediate resistance is around $1766 and a convincing break above will take the yellow metal $1780/$1790/$1800. It is facing strong support at $1745, violation below targets $1750/$1725.

It is good to sell on rallies around $1800 with SL around $1820 for TP of $1750.