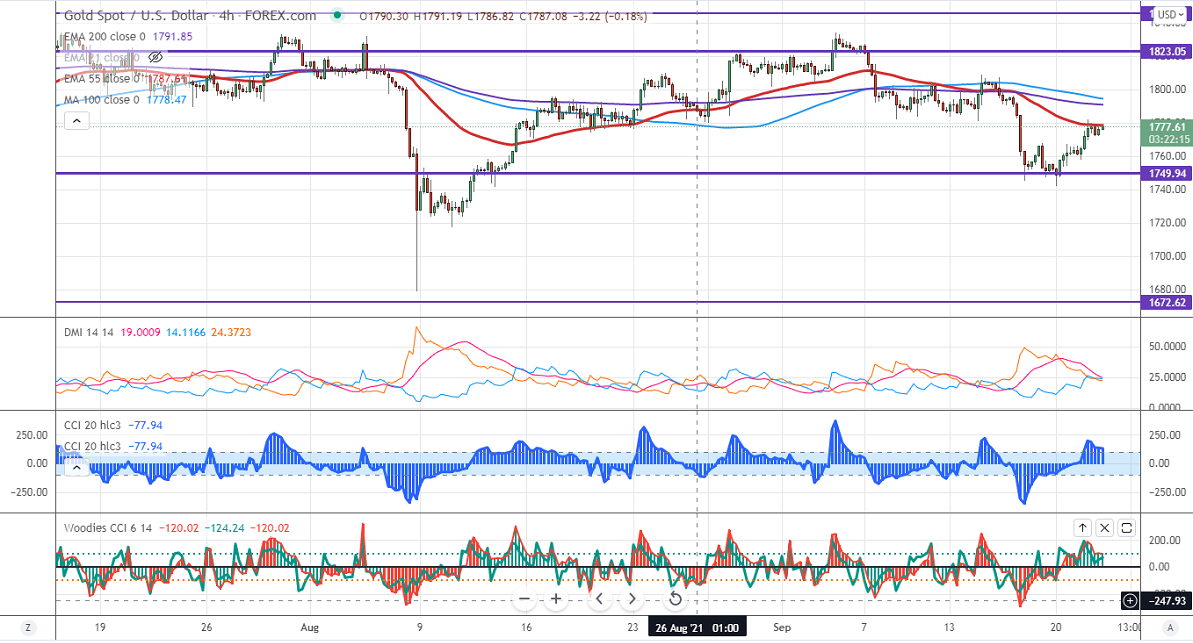

Significant resistance - $1790

Gold is holding above the $1750 level on the Chinese Evergrande debt crisis. The fears of default have increased demand for safe-haven assets like the gold, yen. Markets expect to remain quiet ahead of US Fed monetary policy. The Central bank to keep rates unchanged as expected. The timeline of Fed bond tapering is to be watched for further direction. DXY consolidates in a narrow range between 93.45 and 93.05 for the past two days. Any breach above 93.75 confirms further bullishness. The yellow metal hits a low of $1781 and is currently trading around $1776.

Factors to watch for gold price action-

Global stock market- Bearish (Positive for gold)

US dollar index – Mixed (neutral for gold)

US10-year bond yield- Mixed (neutral for gold)

Technical:

The immediate resistance is around $1782 and a convincing break above will take the yellow metal $1800/$1810/$1825 if possible. It is facing strong support at $1770 (resistance turned into support), violation below targets $1760/$1750/$1740.

It is good to take position after US Fed monetary policy.