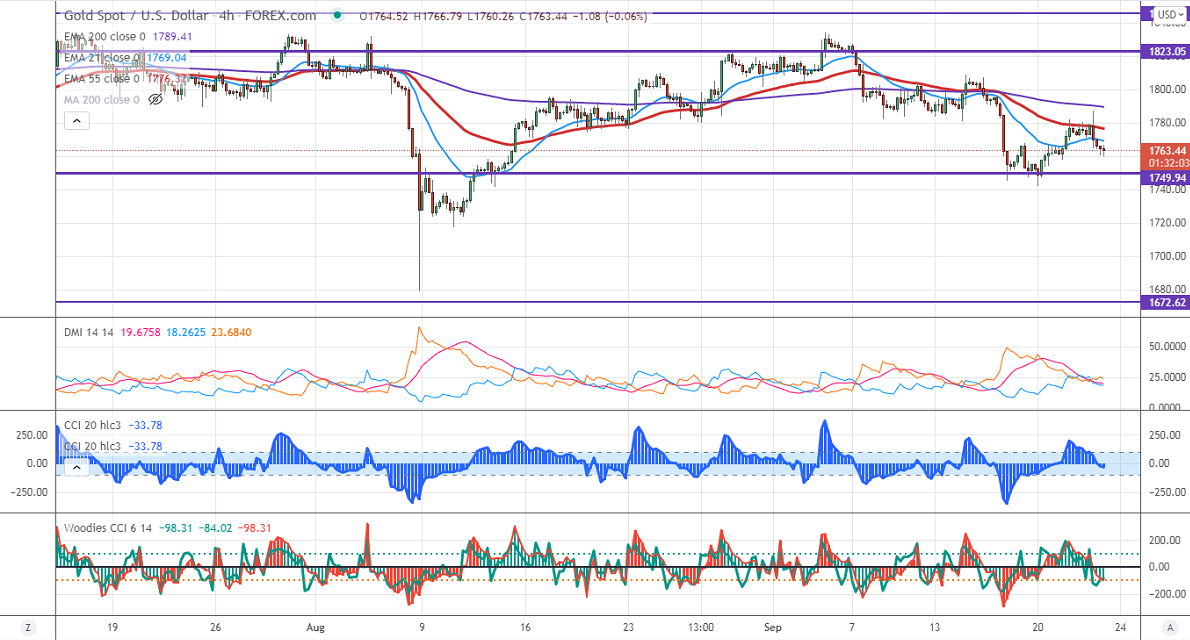

Significant resistance - $1790

Gold has lost more than $20 after Fed monetary policy. Fed has kept its rates unchanged at 0% to 0.25% and maintains its $80 billion treasury buying program as expected. The central bank said bond tapering will start by November 2021 and a rate hike may come in 2022. DXY recovered till 93.52 and shown a minor profit booking. Any breach above 93.75 confirms further bullishness. The yellow metal hits a low of $1781 and is currently trading around $1776.

Factors to watch for gold price action-

Global stock market- Bearish (Positive for gold)

US dollar index – Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The immediate resistance is around $1790 and a convincing break above will take the yellow metal $1800/$1810/$1825 if possible. It is facing strong support at $1760, violation below targets $1750/$1740.

It is good to sell on rallies around $1800-05 with SL around $1820 for TP of $1740.