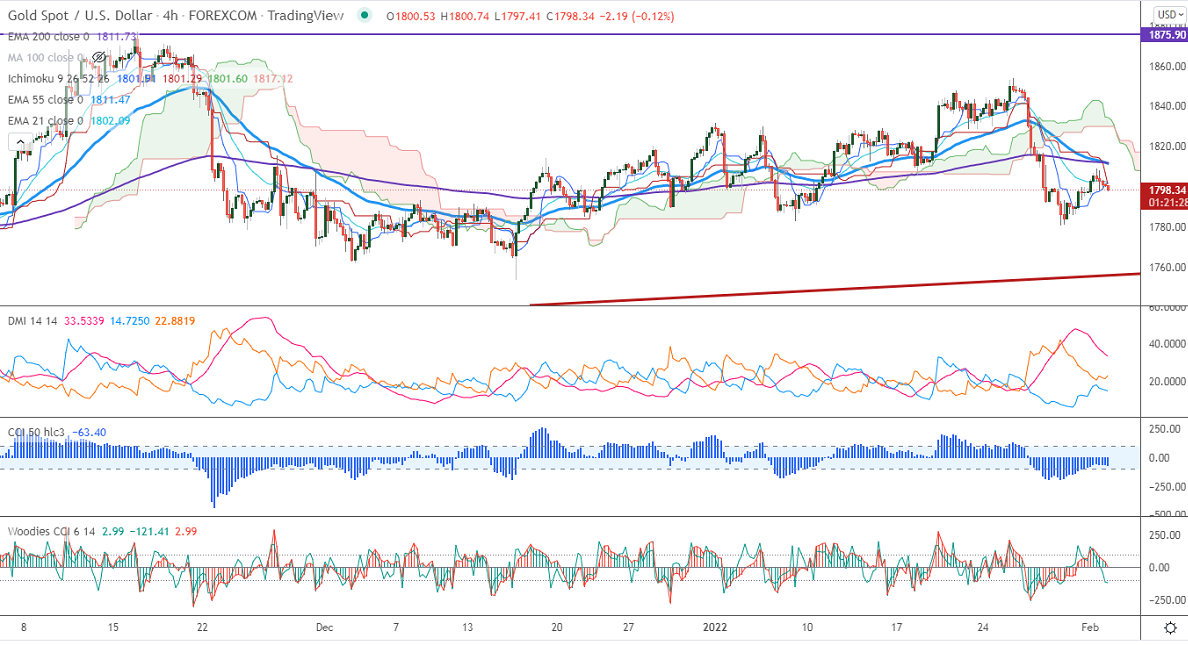

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- $1817.20

Kijun-Sen- $1817.20

Gold struggles to close above $1800 despite the weak US dollar. The US dollar index declined for the third consecutive day after hitting a multi-week high at 97.44. US ISM manufacturing PMI for Jan came at 57.6 compared to a forecast of 57.40. Gold hits an intraday high of $1799.93 and is currently trading around $1798.39.

Markets eye US ADP employment change data today for further direction.

Factors to watch for gold price action-

Global stock market- Bullish (Negative for gold)

US dollar index –Bearish (positive for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1780, violation below targets $1770/$1750. Significant reversal only below $1750.The yellow metal facing strong resistance of $1810, any violation above will take to the next level $1835/$1860/$1877$1912 is possible.

It is good to sell on rallies for $1819-20 with SL around $1835 for TP of $1790.