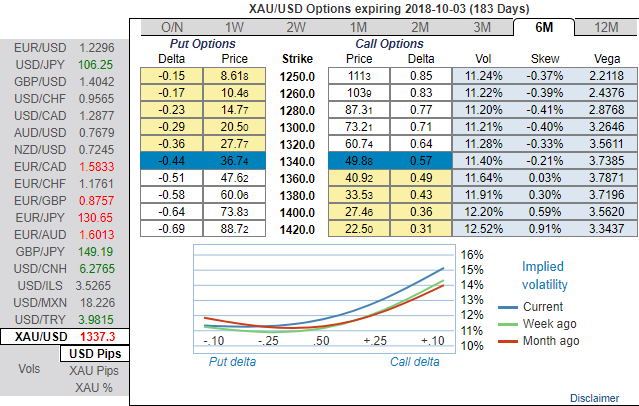

Good ownership in front end Gold skews: With Gold front vols bound to remain firm for longer and as the late cycle Gold rally takes hold on the back of the post-Fed, Gold skews should stay supported even as 3M skews are at the highest level since Aug 2017. Positively skewed IVs of 6m tenors have been signifying the considerable hedging sentiments for bullish risks. While risk reversals have been bullish neutral across all tenors.

Accordingly, we advise long in Dec’18 CME gold as we FX team pulling forward their bearish USD view, we now believe that the persistence of USD weakness is here to stay.

As such, we recently boosted our gold price forecasts and recommended length in Dec’18 CME gold. We saw the early March pullback as an advantageous level to add length and lower our average entry cost.

We initiated longs in gold at $1,352.80/oz for Dec’18 delivery. Added an equivalent unit at $1,327/oz on in the recent past again for a new entry level of $1,339.90/oz.

Trade target is $1,540/oz with a stop at $1,273/oz. Marked to market at $1,356.25/oz on Mar 21, 2018 for a gain of $16.35/oz or 1.2%.

Gold on the Comex division of the NYME dropped by $5.10 but recovered slightly to flash at $1,341.60 a troy ounce by 11:51 AM GMT.

Alternatively, we had also suggested buying delta-hedged 3M XAUUSD 25-delta risk reversals @ 1.3/1.6 vol.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 50 levels (which is bullish) ahead of FOMC Member Brainard speech while articulating (at 11:51 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios