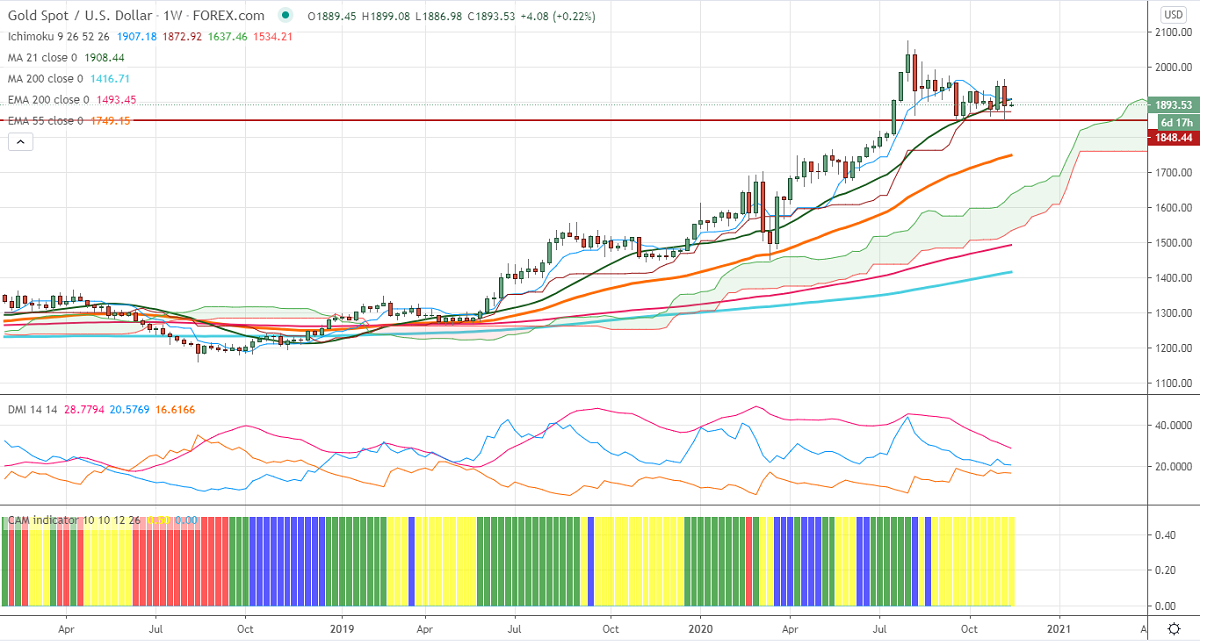

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1911.20

Kijun-Sen- $1872.90

Gold was one of the worst performers in the previous week and lost more than $100 on COVID-19 vaccine hopes. But Trump's legal action against election verdict and lockdown in some states of the US due to coronavirus is supporting yellow metal at lower levels. The dollar index upside capped by 200- day EMA, any violation above 93.20 confirms further bullishness. The US 10-year yield declined more than 10%after hitting a multi-month high.

Economic data:

The number of people who have filed for unemployment benefits declined by 48000 to 709000 levels compared to forecast of 740000.US Consumer price inflation came unchanged at 0% in Oct while producer price came at 0.3% in Oct compared to September's 0.4%. Markets eye US retail sales, Philly fed manufacturing to be released next week for further direction.

Technical:

In the Weekly chart, Gold is facing strong support at $1849 (Sep 24th low). Any break below will take the pair till $$1830/$1800. On the higher side, near term resistance is around $1911 and any indicative break above that level will take till $1922/$1935/$1955.

It is good to buy on dips around $1860 with SL around $1840 for the TP of $1950.