FxWirePro: Gold Weekly Outlook

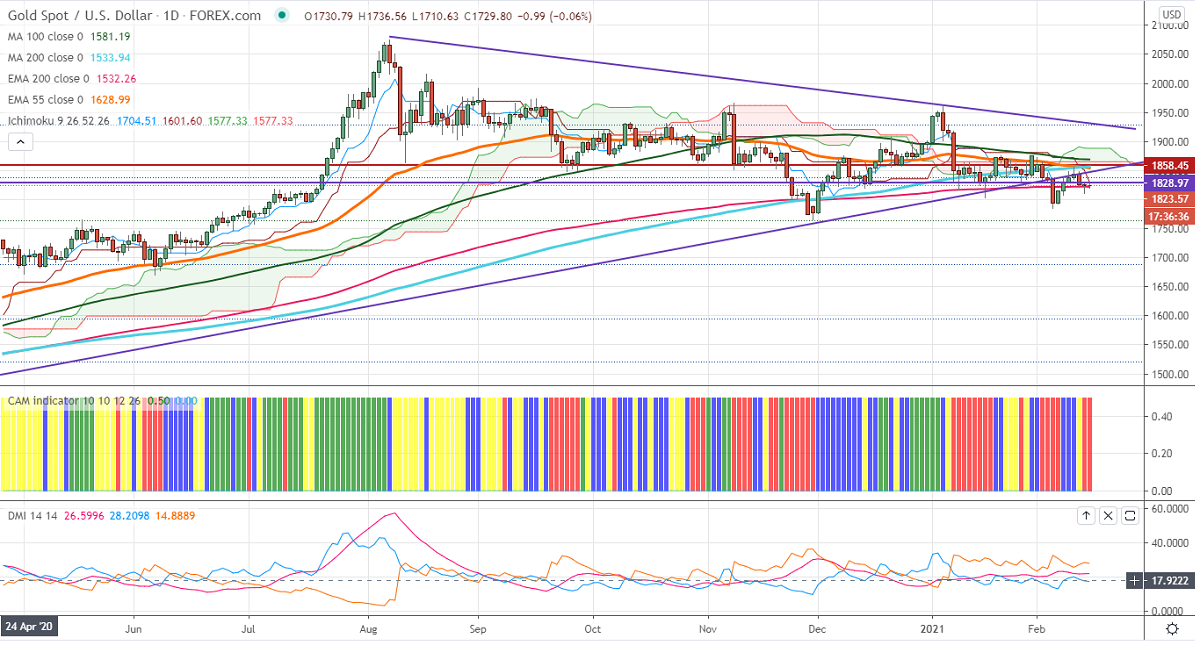

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1824

Kijun-Sen- $1855

Gold is trading slightly lower after hitting a high of $1855 the previous week. The upbeat market sentiment due to progress in vaccination, hopes of more stimuli from the U.S is putting pressure on the yellow metal at higher levels. But lockdown restrictions in major countries such as Europe, Australia, and New Zealand are preventing gold from further selling. The US 10-year yield hits a fresh year high amid mixed US inflation data.

Economic data:

US core inflation for Jan (MoM) came at 0% compared to expectations of 0.2%. The headline inflation in line with expectations for Jan at 0.3%. The annual inflation slowed down to 1.4% from 1.6% in December. The number of people who have filed for unemployment benefits rose to 793000 compared to a forecast of 76000. Continuing claims benefits declined by 145000 to 4.54 million.

Technical:

It is facing strong support at $1780 (55-W EMA), violation below targets $1764/$1720. On the higher side, near term resistance is around $1860, any indicative break above that level will take till $1882/$1900.

It is good to sell on rallies around $1845-46 with SL around $1860 for the TP of $1785.