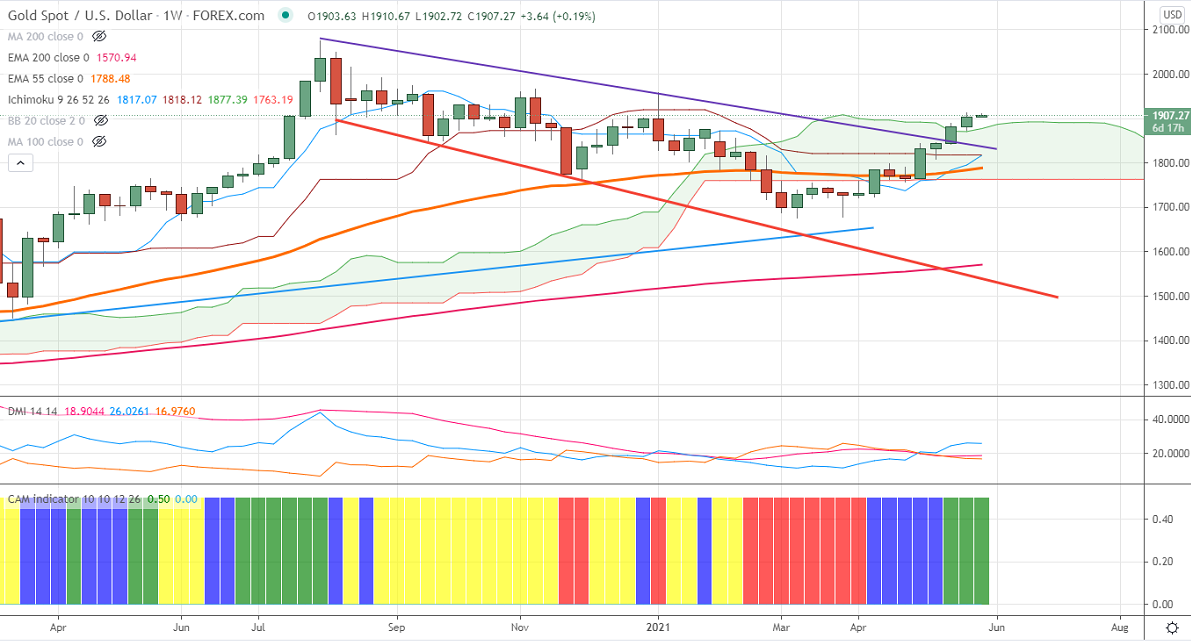

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1784

Kijun-Sen- $1818

Gold is trading higher for a fifth consecutive week and surged more than 8% on board-based US dollar selling. The Fed member's comments show that the central bank is expected to continue accommodative despite higher inflation. The US 10- year yield continues to trade weak after a minor pullback. The US dollar index lost more than 50 pips after forming a minor top around 90.44. Gold hits a high of $1890 and is currently trading around $1884.12.

Economic data:

The conference board consumer confidence eased to 117.2 in May compared to a forecast of 118.80. The US first-quarter GDP came unchanged at 6.4% slightly less than the forecast of 6.5%. US Durable goods orders declined by 1.3% weaker than the estimated 0.8%. The number of people who have filed for unemployment benefits dropped to 406000 last week.

Technical:

It is facing strong support at $1880, violation below targets $1870/$1860/$1840/$1820. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1912, any convincing break above confirms bullish continuation. A jump to $1932/$1950 is possible.

It is good to buy on dips around $1878-80 with SL around $1860 for the TP of $1932.