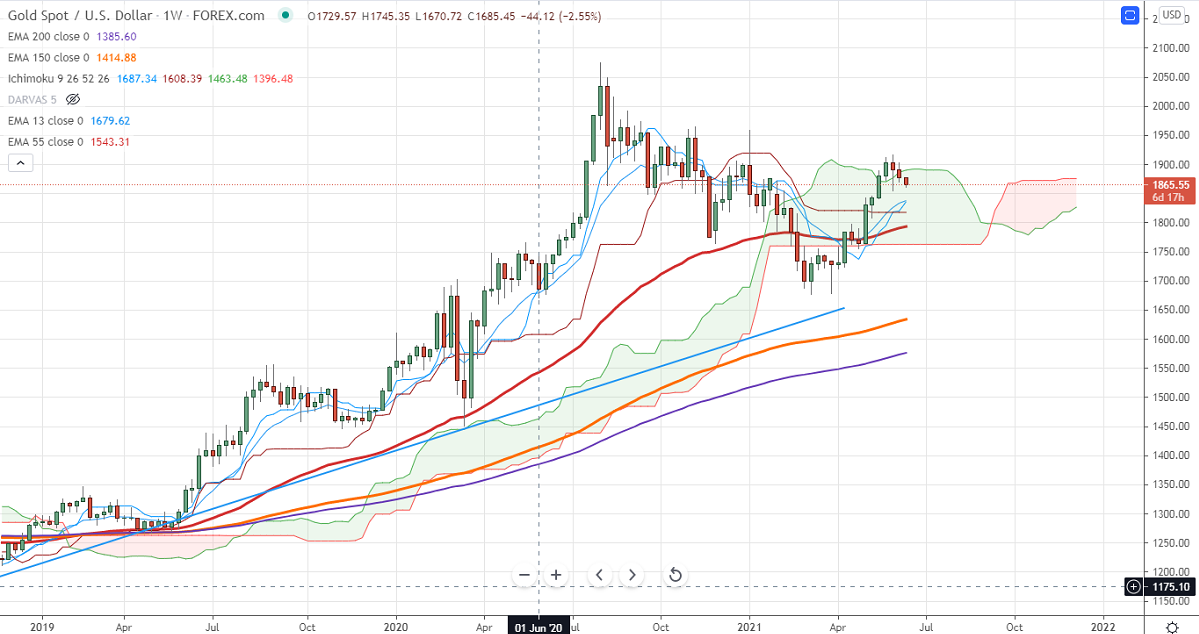

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1820

Kijun-Sen- $1818

Gold continues to trade week for a third consecutive week on a strong US dollar. The US dollar index is holding well above 90 levels, any breach above 90.63 confirms further bullishness. The sell-off in US bond yields after upbeat inflation data is preventing the yellow metal from further downside. Gold hits an intraday low of $1860 and is currently trading around $1864.34.

Economic data:

The US Headline inflation surged to 5.0% in May compared to a forecast of 4.7%. The core CPI came at 3.8% highest since 1992. The number of people who have filed for unemployment benefits has declined to 376000 from 385000 the week before. The European central bank has kept its rates unchanged as expected and to continue its bond-buying program until Mar 2022. Markets eye US Fed monetary policy for further direction.

Technical:

It is facing strong support at $1850, violation below targets $1840/$1820/$1790.Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1903, any convincing break above will take the yellow metal to $1912/$1932/$1950 is possible.

It is good to sell on rallies around $1882-83 with SL around $1903 for the TP of $1790.