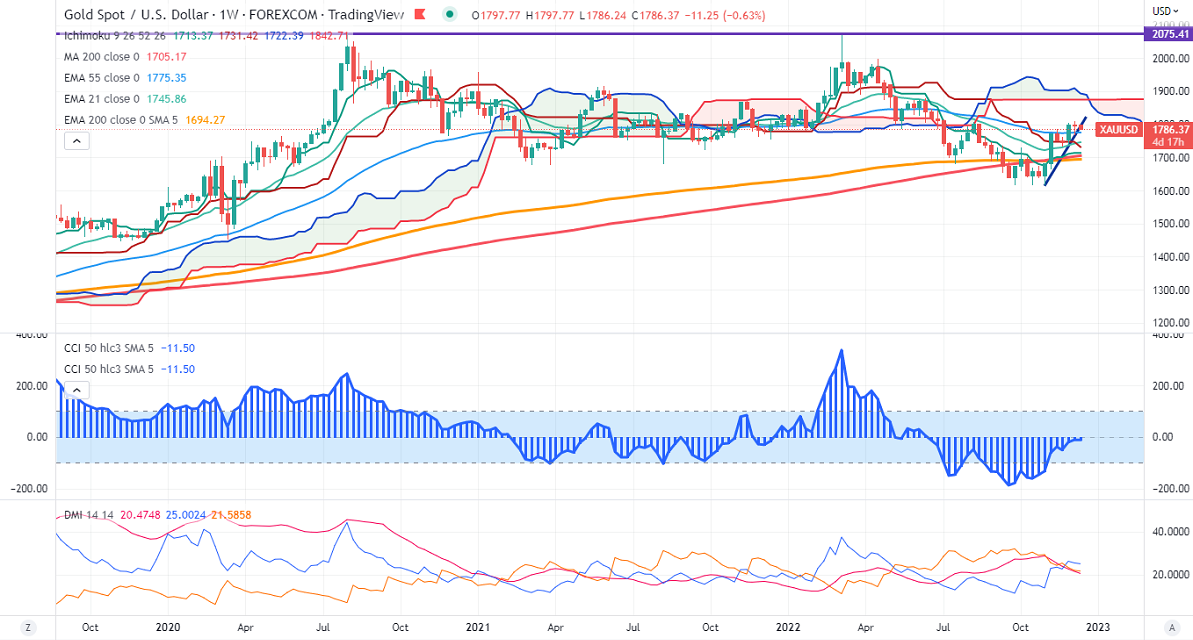

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1713.37

Kijun-Sen- $1747.06

Gold has traded flat for the past week between $1806 and $1767. Market eyes US Fed monetary policy and CPI data for further direction. The yellow metal hits a high of $1810 and is currently trading around $1788.51.

The bank of Canada raised rates by 50 bpbs and said that further rate hikes will depend on the performance of the economy. Reserve bank of Australia hiked rates by 25 bpbs. US ISM series PMI came at 56.50 in Nov from 54.40, the highest level since Mar 2021.

US dollar index- Bearish. Minor resistance around 105.50/106.20. The near-term support is at 104.80.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Dec declined to 74.70% from 78.20% a week ago.

The US 10-year yield gained more than 5% from yesterday's low of 3.404%. The US 10 and 2-year spread widened to -78.80 basis points from -67 bpbs.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (Positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1760, a break below targets of $1740$1720/$1700. The yellow metal faces minor resistance around $1820, breach above will take it to the next level of $1860/$1900.

It is good to buy on dips around $1760 with SL around $1740 for TP of $1860.