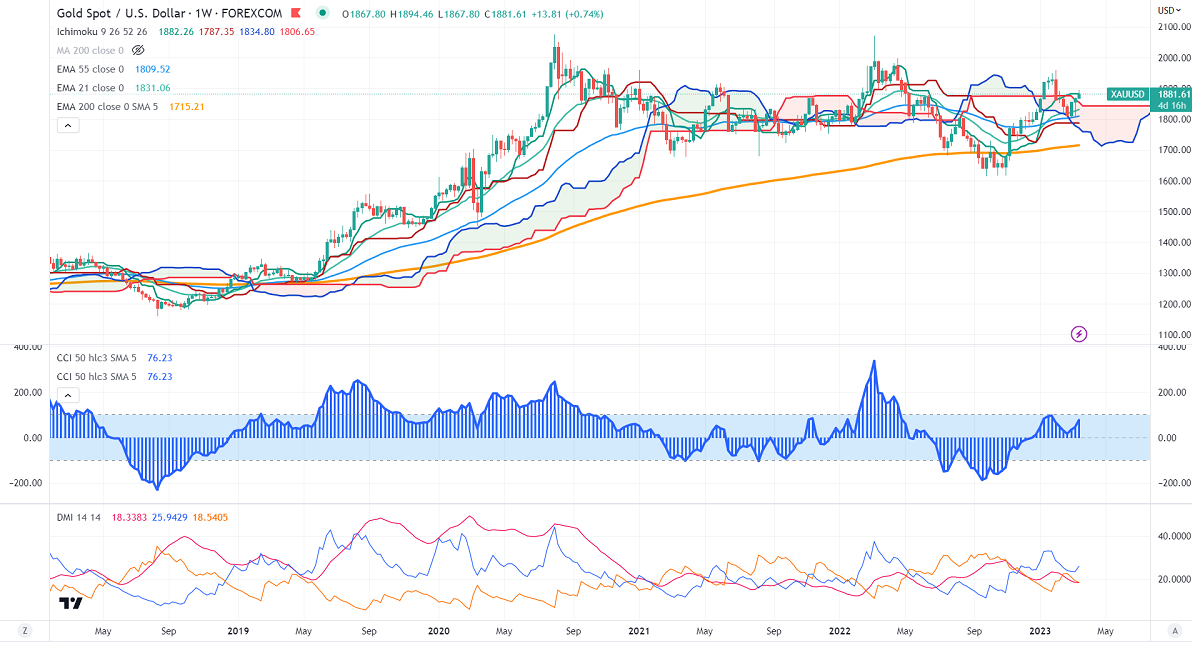

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1882.25

Kijun-Sen- $1787.50

Gold prices surged higher the previous week after the US SVB collapse. Silicon valley bank, the 16th largest bank in the US failed on Friday and was taken by FDIC. The treasury department, federal reserve, and FDIC jointly announced efforts to help assured banks have the ability to meet the needs of all their depositors. Gold hits a high of $1894.50 and is currently trading around $1882.83.

The US economy has added 311000 jobs in Feb from the previous month's 517000, above the estimate of 225000. The unemployment rate increased to 3.6% from 3.4%.

The number of people who have filed for unemployment benefits rose to 211K for the week ended Mar 14th, compared to a forecast of 195K.

Major economic data for the week

Mar 14th, 2023 US CPI m/m (12:30 pm GMT)

Mar 15th, 2023 US PPI m/m (12:30 PM GMT)

US retail sales m/m (12:30 GMT)

US Empire state manufacturing Index ( 12:30 pm GMT)

Mar 16th, 2023 ECB monetary policy (1:15 pm GMT)

US dollar index-Bullish. Minor support around 104.60/103.70. The near-term resistance is 106/107.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Mar increased to 96% from 59.8% a day ago.

The US 2-year yield declined drastically on Friday following the shutdown of SVB bank. The US 10 and 2-year spread narrowed to 71.4% from -107%.

Factors to watch for gold price action-

Global stock market- bearish (Positive for gold)

US dollar index - Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1870, a break below targets of $1860/$1840.The yellow metal faces minor resistance around $1885, and a breach above will take it to the next level of $1900/$1920/$1959.

It is good to buy on dips around $1868-69 with SL around $1858 for TP of $1920.